Credit limit too low?

DON'T just cancel the card

You're pleased as you've been accepted for a new credit card. However, you then spot the credit limit is too low to cover the purchase you need it for, or you're unable to shift all your debts to it. Yet don't just cut up or cancel the card just to spite the bank. It's likely to hurt you more than them. Instead, this quick guide will show you how to deal with it.

Take a look at the email below – it's typical of the type that lands in our inbox all the time.

Hi, I've an outstanding balance of £3,000 on a credit card with Suntanner Bank and I tried to shift it to Barstools Bank's 25 month 0% deal for a 2% fee.

I applied online, told them I wanted an interest-free balance transfer of £3,000 and gave them the card number as requested. I got accepted OK, but with a miserable credit limit of £1,500 so no possibility of a transfer. I've told them what to do with their card!

Of course it may feel good, but it's actually biting off your nose to spite your face. Here's a quick Q&A to take you through how it works, and what you can do. Note that this guide is for NEW cards. For dealing with old ones, see Cancel unused credit cards?

What is a credit limit?

When you get a new credit card, that card will come with a credit limit. This is the maximum amount the lender is prepared to lend you on this card. If you spend more and go over your credit limit, you're likely to face a £12 charge for doing so.

The average credit card limit in the UK is between £3,000 and £4,000, though the limit you get will very much depend on your income and credit history. If you've a lower income and/or a poor credit history, you're likely to get limits starting around £200 with a maximum of £1,500. Yet, higher income earners with a good credit history could see limits of £10,000+.

If your limit is too high and you'd find that too tempting, you can ask the lender to reduce your credit limit. Yet a more common problem is a credit limit that's too low, especially if you're trying to shift debt to it. This guide takes you through what to do in this situation.

Why do lenders give such low credit limits?

When you apply for any product, each lender scores you differently depending on its own wish list of what makes a profitable customer. It's important to emphasise that this is about profit and not just risk.

Of course, if you're a bad risk then you're unlikely to be profitable. However, even if you pose little risk, there are other factors the bank will consider, including...

-

Outstanding debts. How much you owe other cards, loans, overdrafts, etc.

-

Available credit. The amount of debt you could potentially have if you used all credit available to you – even if you're not currently borrowing anything.

-

Repayment history. Whether you've ever missed or been late in making repayments.

-

Scoring out 'players'. Though it's difficult to do, banks will try to score out people they think are playing the system.

All these play a part. But it's also important to remember that, as a whole, credit scoring has tightened up and credit limits have been reduced in recent years. This is mostly down to increased regulatory pressure on 'responsible lending' (though it's ironic that 'responsible lending' can lead to some people being unable to cut the cost of existing debts).

In general, credit limits are lower and it's more difficult to get accepted than a few years ago. For full info and tips on how to boost your creditworthiness, see our Credit scoring guide.

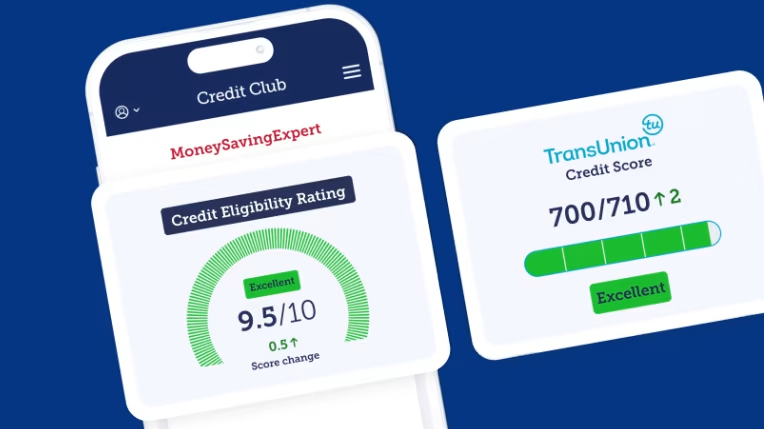

Try our free Credit Club

MSE's Credit Club shows your real-world credit power – which translates to acceptance for credit cards, loans & more – and explains how to improve things.

MSE's Credit Club uses a new Eligibility Rating which combines the THREE crucial factors that dictate whether a lender will accept you, to show a far bigger picture...

1) Your credit score

2) Your affordability score (which, crucially, includes income)

3) Current market conditions

Once logged in, you can also use our Credit Cards Eligibility Calculator to see which cards you'll most likely be accepted for, without impacting your ability to get future credit.

It'll also show your credit report and other related info, plus gives access to our eligibility calculators for loans and mortgages.

Can I ask my lender to increase my credit limit?

If you're not happy, there's nothing wrong with telling the card company, and asking for a higher limit. Of course, it doesn't mean you'll get it.

You'll usually have a better chance of getting the limit increased after you've had the card for a reasonable length of time. The initial 'review' period is often around three to six months.

The only problem with this is some 0% balance transfer deals require you to shift the debt within the first 60 or 90 days or so to be eligible to get the 0% deal, so it may be too late for that. Don't assume you can simply shift debt across and still get the cheap rate once the credit limit is increased – always check.

However if you want a limit increase to borrow more, question whether you really need it. If card companies aren't willing to lend, you should take it as a warning that it may not be affordable.

Before getting any credit: if you have any savings put aside, it's likely to be worth paying down debts with these, so the limit you need is lower. Read the Debts vs savings guide to see if it's right for you.

What's wrong with just cancelling the card?

It's a bit like punching a brick wall. You'll feel the pain more than it will. There are two reasons for this...

It's already had an impact on your creditworthiness

Every time you apply for a new credit card, especially in a short time period, it adds a search to your credit report. These searches usually have a minor negative impact on your acceptance chances the next time you apply for new credit.

The fact you have the card means you have another line of credit available to you, and that too is likely to diminish your ability to get other credit. Even if you cancel the card (officially, not just cutting it up), that is a process which takes time.

Put a little less technically, your credit score has already paid for the card. It won't magically rekindle if you don't use it.

You'll need to apply for a new one anyway

This will take time, so you'll be missing out on any benefit in the meantime. Also, we assume you chose the card because it was the right one for you – so while you may have less function with it than you'd hoped, can it still be used for something?

Getting rid of the card just means you've thrown away some cheap available credit, and eroded a little of your ability to get further cheap available credit. So even though it's always nice to tell the bank where to stick it, sometimes you may just find you're the one who is stuck.

What should I do with the low limit card?

Certainly if you got it to shift debt to (do a balance transfer) and it's cheaper than the cards you've currently got, shift the debt to it up to the maximum allowed.

Going back to the email that prompted this...

I applied online, told them I wanted an interest-free balance transfer of £3,000 and gave them the card number as requested. I got accepted OK, but with a miserable credit limit of £1,500 so no possibility of a transfer. I've told them what to do with their card!

In this case, assuming the £3,000 is currently at a high rate of 22% a year, at least shifting half the debt will save you over £300 in interest over the next year. That's not a bad start – and you'll start saving instantly.

Plus, there's no rule that says you must balance transfer only to one card. If you have more debts to move, simply apply for another card. The only negative is that you have two cards rather than one, which may be more complex, and can affect your total minimum repayments.

Beware of over-borrowing, though. And it's always worth checking your credit reports before applying again to ensure the low credit limit wasn't due to an error on them.

See our credit card guides for all our current top-picks and our Credit Card Eligibility Calculator which will show cards you've the best chance of getting, in your own personal best-buy table.