Balance transfer credit cards

Shift existing card debt to 0% interest for up to 36 months

Paying credit card interest? STOP. A balance transfer credit card can save you £1,000s by slashing the interest you pay. Our guide has full info and top picks, plus our Balance Transfer Eligibility Calculator will reveal the cards you've the best odds of getting.

First, a quick overview of balance transfers...

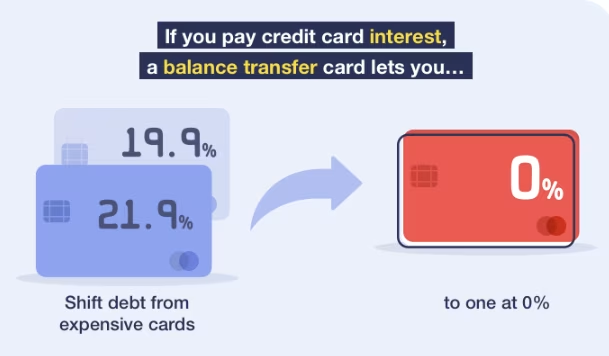

If you've debt on a credit card, a 0% balance transfer card is a powerful tool to slash costs. It pays off the debt on your existing card(s) for you, so you owe it instead, but interest-free for a set time. That way, more of your repayments clear the debt, rather than just paying interest....

Don't just apply - go via an eligibility calc. Our 0% Balance Transfer Eligibility Checker speedily shows acceptance odds for top cards (some are 'pre-approved'), without affecting your creditworthiness.

Go for the LOWEST FEE within a 0% time long enough to clear the debt. Longer balance transfers usually have a bigger one-off fee to transfer. So if you've a choice and can clear debt quicker, go for a shorter deal to minimise fees. Unsure? Go long.

Bank | 0% period | Fee |

|---|---|---|

DEFINITE 36mths + possible £25 cashback | 3.45% | |

Up to 36mths | 3.29% | |

Up to 36mths | 3.45% |

These are our top few cards, see our full review for more options. Links go via our eligibility calc, unless stated.

Bank | 0% period | Fee |

|---|---|---|

Up to 14 months | NO FEE | |

12 months | NO FEE | |

15 months | 0.75% |

These are our top few cards, see our full review for more options. Links go via our eligibility calc, unless stated.

If you do get a card, ALWAYS follow the Balance Transfer Golden Rules:

a) Never miss the minimum monthly repayment, or you could lose the 0% deal.

b) Clear the card before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend or withdraw cash. It usually isn't at the cheap rate.

d) If you don't transfer at application, you've usually only 60-90 days to get 0% deal.

Now that we've given you a brief overview and you understand the basics, let's take you through balance transfers in more detail...

What is a 0% balance transfer credit card?

With a 0% balance transfer you get a new card to pay off debt on old credit and store cards, so you owe it instead, but at 0% interest.

A card will have a 0% period, during which you pay no interest – for example, 25 months – and in return you'll usually pay a small transfer fee. It means you become debt-free quicker, as more of your repayments reduce the debt, rather than pay off interest.

Before moving on, there are some key terms to familiarise yourself with first...

The balance transfer period. This is how long you get at 0% interest.

The balance transfer fee. This is a one-off fee calculated as a percentage of the amount of debt you transfer to your new card. Typically, the longer the period, the higher the fee. Some credit cards offer shorter periods where you pay no fee, though these are rare.

The APR. This is the rate of interest at which you will be charged after the 0% period ends, should you have debt remaining on the card. The higher the APR, the more you'll be charged on any outstanding balance.

How does a 0% balance transfer work?

See Martin's understanding 0% balance transfers video for a full explanation, but in brief...

A balance transfer allows you to transfer debt from one credit card provider to another. To do this you must open a new balance transfer credit card, which are specifically designed for this process. You can then request a balance transfer of all or some of your debt from old credit cards and it will be transferred to your new card. You usually need to request this within the first 60 to 90 days – if you delay, you could lose the promotional 0% deals.

Transcript of what Martin said on the show

From The Martin Lewis Money Show Live on Tuesday 21 January 2025, courtesy of ITV. All rights reserved. Watch the full episode on ITVX.

"Okay, so what is a 0% balance transfer? This is for cutting the cost of existing debts. It's absolutely the crucial weapon. I want to really break it down for you. Let's imagine you have £2,300 worth of debt, one on a Stalecard and one on a Rottencard, both at relatively high rates of interest.

"So what do you do? Well you apply for a new card that's got a specific balance transfer deal to shift the debt. Here we go. The new card. We'll call it the Martcard. Hey, why not? It's 31 months at 0%. You've got a £2,000 credit limit. So what do you do? Well, the first thing is you look at the most expensive debt. That's the one growing quickest.

"That's the one you want to get rid of. And you say, “Please pay the debt off that one.” And that's what the balance transfer is. There we go. The new card pays off the debt on the old card. So you now no longer owe it. It's debts gone down to £0 and you now owe £1,400 pounds, but at 0% for 31 months.

"But you've got a credit limit of £2,000. Now, in terms of balance transfers, they only let you balance transfer 90% of the credit limit. So that's £1,800 in this case. So we've got £400 left. Well you may as well do it again. There we go. Pay off the Stalecard. Now you've got £1,800 worth of debt here and only £500 worth of debt on the Stalecard.

"So if we think of it, roughly your average before was around 23 or 24% APR on £2,300 debt, about £600 a year interest you were paying, now that's all interest-free. You got only £500 debt on there. So that's what, just over £100. That's £500 of interest saved, which means far more of your money is clearing the actual debt rather than just paying the interest. And that gets you debt free quicker. That's why balance transfers are so important.

"You have something? [speaking to his co-host]. "Yeah I have. Anne’s been in touch [referring to user who has written in to the show], she wants to know on this one...

“I have a £4,500 credit card debt, and I'm thinking of a 0% balance transfer. I've been offered a 13 month interest-free credit card for £2,750. Is it worth me doing this as doesn't cover the full amount?”

"Yes yes yes yes yes. Okay. Right. You've made an application. It's gone on your credit file. Your credit file is already affected. You've already spent your creditworthiness and you spent it on a really good thing cutting the cost of your debt. People often get in touch and they say the credit limit they’ve given me is too low. What should I do?

"Well, use it even if it's for £200. £200 at 0% is better than £200 at 25%. So if we talk about that £2,750, assuming you're on a typical APR is £700, £800 a year, you're paying and you could now be paying 0%, even though the rest of your debt you're still paying interest on.

"It's quite like this scenario [referring to the Stalecard, Rottencard and Martcard from earlier]. It's still worth doing. Then once that money's been shifted across, then now get back onto an eligibility calculator, more on that in a moment, and let's see if you can get another balance transfer for the rest. It might be slightly more difficult. You might not be able to get it, but at least you're bringing your interest rate down. So if you get a low credit limit, still use it. You've spent it, back with the application, use it.

[His co-host speaking] "Okay, now I think people want to know Martin about the best deals." [Martin replies] "And that’s my job, that’s what I do." [His co-host continues] "Lorna that's been in touch here. Lorna’s asking...

“What is the best and cheapest way to get rid of credit card debt?”

[Martin continues] "Well, let me carry on to my next page. Okay. So my big message to anyone who's paying interest on credit card debt. If you cannot afford to clear your credit card debt or your store card debt, you can't afford not to try to lower the interest rate, maybe to interest free.

"So rule number one is protect your credit history. Use an eligibility calculator first. That is a tool. Better to do one where you get a comparison. It will tell you your odds of getting the top cards, and it does that before applying so you can see which [you] are most likely to get so you can home in and hopefully apply where you're going to be successful to minimise the impact on your credit file. So I'd always apply via an eligibility calculator. Some individual card firms have them, but I go for one that gives you a spread of different cards, so you can see what's most likely.

"Rule number two. When you do a balance transfer there's usually a one-off fee, the amount you're shifting. So if you're shifting £1,000 and the fee is 3%, you pay £30 to do it. So, the longer the card, the bigger the fee. If you can repay more quickly and you're sure you can repay more quickly, go for a shorter card, lower the fee because it'll cost you less. But if you're not sure, just go long. Have a longer 0%, play safe."

As an example, imagine you've had to make a few unexpected purchases on your credit card, so you owe £4,000 and are being charged 24.9% annual interest...

-

To avoid paying any interest, you open a balance transfer credit card with 20 months at 0% and a one-off fee of 3% of the amount transferred.

-

Following your transfer request, the £4,000 is transferred from your existing credit card to the new card, which including the 3% fee gives you an outstanding debt of £4,120.

-

You close the old card (as all outstanding debt has been transferred) and now have 20 months to pay off the £4,120 without being charged any interest.

-

Paying £206 per month over 20 months would accomplish this.

As you can see, these cards can offer a vital relief from interest charges, allowing you some breathing space to pay off debt as quickly as you can.

0% balance transfers: the five golden rules

Get this wrong and it can cost you large, so please read the following.

Always clear debt or shift again before the 0% or cheap rate ends, or costs can rocket

Cheap balance transfer deals are designed to make lenders money when the 0% period is over, as interest rates jump massively (typically to between 20% and 40%). Yet this can be avoided...

Aim to clear the balance before the end of the 0% transfer period. Quite simply, divide the amount you owe by the number of months at 0%, then pay at least this every month to pay it off in time.

If you can't clear it in time, balance-transfer again to another 0% offer. If you can't afford to repay in time, the next best bet is to shift the debt again, before the end of your 0% period. If you're not eligible for any cards, you could consider transferring back to the original card you shifted the debt from, if it's still open and cheaper than the interest rate on your current card.

Repay AT LEAST the monthly minimum or you may lose the cheap rate

Just because you grabbed a 0% deal DOESN'T mean you can get away with paying nothing – you must pay at least the minimum monthly payments, preferably more. Otherwise you will be hit with penalties and some card providers will withdraw the deal, leaving you on an expensive rate.

How much should I aim to pay?

Your aim should be to pay more than the minimum – unless you've pricey debts elsewhere, in which case focus max repayments on them. Minimum payments are designed to make debts last as long as possible, which you should try to avoid – see our Credit Card Minimum Repayment Calculator for tips to beat this.

Don't spend or withdraw cash – it's usually at an expensive rate

While balance transfers made to the cards in this guide are interest-free for a number of months, other uses such as spending and cash withdrawals are usually not – and will incur charges and interest.

For cash, you'll usually pay any interest from the date of the withdrawal until it's paid off.

This means you'll most probably see an interest charge on the first statement after the withdrawal, which is the interest charged from the date you made the withdrawal until the date the statement was issued.

But you may also see interest charged on the following statement. There'll be a delay between your statement being drawn up, and you paying it. It may be a couple of days, it may be a couple of weeks. But interest will be charged on the withdrawal until you pay it off.

There are special cards if you need to shift debt AND spend

If you also need to spend on the card, it's best to get an all-rounder card, which has a 0% length for balance transfers AND spending, and means you only need to apply for one card. Check our 0% balance transfer & spending guide for full info, or alternatively you could try a separate 0% credit card for purchases.

To get the 0% and fee, you usually have to transfer within the first one to three months

For most cards, the 0% period is only reserved for balance transfers that are made within the first 60 or 90 days – though always check your card for its time limit, as it does vary. After this has passed, any transfers would incur expensive interest at the card's normal rate, unless it's paid off in full.

This can sometimes apply to the one-off fee too, so it's likely you'd pay a higher fee on later transfers, in addition to interest.

There are some notable exceptions to this though, with certain cards requiring you to request the balance transfer when you apply, and others allowing transfers at any point during the 0% period. But as the 0% period usually starts on the day the account is opened, you'd have less interest-free time if you waited.

How to request a balance transfer

When you apply for the new card, it will usually include a 'Do you want to transfer debts from other cards?' section. Here, put in the details of the other card(s). If you're successful in getting the new card, it will pay the other one(s) off.

If you don't do it at the initial application, you can usually submit the request via your card's online banking or by calling the lender.

You can't balance-transfer between two cards from the same bank or often the same banking group

For balance transfers, one rule is clear – you can't transfer a balance between two cards issued by the same bank (for example, from one Barclaycard to another).

However, for some cards it's a bit more complicated, as certain providers extend this to prevent transfers between cards from the same banking group:

Banking group | Credit cards you can't transfer a balance between |

|---|---|

Capital One | Capital One, Littlewoods, Luma, Ocean, Post Office (cards issued after November 2019), Thinkmoney and Very |

HSBC | First Direct, HSBC and M&S Bank. John Lewis cards applied for before 21 September 2022 are with HSBC group too. |

NatWest | NatWest, Royal Bank of Scotland and Ulster Bank |

NewDay | Amazon, Argos, Aqua, Fluid, John Lewis (if you applied for a card on or after 21 Sep 2022), Marbles and Opus. You're also unable to transfer a balance from a store card or American Express |

Santander | Cahoot and Santander |

Virgin Money | B, Clydesdale Bank, Virgin Atlantic, Virgin Money and Yorkshire Bank. You're also unable to transfer a balance from a non-UK issued American Express (for example, British Airways Amex) |

Try our free Credit Club

Sign up to MSE's Credit Club to boost your credit power – access our free tools to see how the financial world views you, including:

An Eligibility Rating that combines your credit score, affordability, and market trends.

View your full credit report – your financial CV.

Get personalised acceptance odds for credit cards and loans.

Which 0% balance transfer credit card is best for me?

First up, you can't transfer a balance between cards from the . So where you're transferring debt from will narrow down the choice. Of those left, which card to go for will depend on how long you need to clear your debt, and which you're eligible for (as you'll need to pass a credit check as part of any application).

Our eligibility calculator will show your chances of acceptance for most of the top interest-free balance transfer cards in this guide, with no impact on your credit score. If it shows you're eligible for many cards but you're unsure which to pick, follow this rule...

Go for the card with lowest fee in the 0% period you're sure you can repay it in. Unsure? Play safe and go long.

Best 0% balance transfer credit cards

We've highlighted the standout cards here, but our eligibility calculator includes many more — so it's the best way to get your personalised best-buy table. All the links in the table go via our eligibility calculator (unless stated), and it also shows if you’re ‘pre-approved’ for any cards — with some even offering a guaranteed credit limit. Two key tips:

-

As we said above, go for the lowest fee with a 0% period long enough to clear the debt. Longer balance transfers usually have a bigger one-off fee, so if you can go shorter, it's cheaper. If you're unsure, play it safe and go long.

-

If a card is an 'up to', check the 'backup' rate. With 'up-to' cards, some accepted customers get a backup rate, which isn't as good as the headline rate. We show it below, so you can factor it in.

Longest 0% & it's a DEFINITE, with a possible £25 cashback. A full three years at 0%, this will be a winner if you need the max time to clear your debt. Plus, transfer £2,500+ within 60 days to get £25 cashback and 12 months' Apple TV subscription.

Headline (and only) rate:

36mths 0% with 3.45% fee (24.9% rep APR after 0%)

Long 0% & it's a DEFINITE. Although one month shorter at 0%, this card has a lower fee than Barclaycard above. It could be a winner if you won't hit Barclaycard's transfer trigger of £2,500 to qualify for the £25 cashback and can clear your debt within the 35 month 0% period. (Existing HSBC customer? Use this link)

Headline (and only) rate:

35mths 0% with 3.19% fee (24.9% rep APR after 0%)

Joint-longest 0% & lower fee, but an 'up to'. This has the lowest fee of all the 36 month 0% cards, so could be a winner if you're pre-approved. But as it's an 'up to', some accepted customers will get the worse back-up deals below. Thankfully, our eligibility calc shows what you'll get in advance, so you have certainty before applying, which should help you decide.

Headline rate:

36mths 0% with 3.29% fee (24.9% rep APR after 0%)

Backup rates:

35mths 0%, or 20mths with 3.49% fee, 18mths with 3.79% fee, 16mths with 3.99% fee

Long 0%, but an 'up to'. This card offers up to 36 months at 0% but you may be offered a shorter interest-free period unless you're pre-approved via our eligibility calculator. If not, you may still be approved for a slightly shorter 32 or 30 month term with the same 3.45% fee – so it could still be worth applying for if you've good odds of acceptance and you can afford to clear the debt in less time.

Headline rate:

36mths 0% with 3.45% fee (24.9% rep APR after 0%)

Backup rates:

32mths or 30mths 0% (3.45% fee)

Long 0%, but an 'up to'. This card has a long 0% period at 35 months, though has the highest fee of all our top-picks. As it's an 'up to' card, some accepted customers will get its shorter backup rates, so another card could be safer. You can only apply for this card direct with TSB (it's not in our eligibility calculator), though you can check your likelihood of acceptance on TSB's site before you apply without impacting your credit file.

Headline rate:

35mths 0% with 3.49% fee (24.9% rep APR after 0%)

Backup rates:

32 or 29mths 0% (3.49% fee)

Longest NO-FEE 0%, but an 'up to'. Used right, no-fee cards means absolutely no cost. If pre-approved in our eligibility calc, you'll definitely get 14mths which is a good deal. If not, we're told roughly one in five get the backup rate, so you may be safer going for the card below. Note: You can get an extra month at 0% plus £20 cashback & a year's Apple TV if you successfully apply via Compare The Market and transfer £2,500+.

Headline rate:

14mths 0% with NO FEE (24.9% rep APR after 0%)

Backup rate:

7mths 0% with NO FEE

Best 0% balance transfer credit cards for bad credit

To be accepted for most of the deals above, you need a decent credit score. If that's not you, there's still hope, as a few providers offer cards for those with a patchy credit past – though the 0% transfer periods are usually much shorter. Some will accept you even with past defaults or county court judgments (CCJs). See Credit cards for bad credit for full info.

The cards below are all included in our eligibility calculator, but they're worth highlighting because of one big difference...

The interest rates after the 0% periods end are VERY expensive, so plan how much to shift. All the cards below charge up to 34.9% rep APR after the 0% periods end, so compare that against your current card's interest rate. If your current card's rate is higher, then shift as much debt as possible. If it's lower, then only shift the amount of debt you're sure you can clear within the 0% period.

All accepted get 23mths 0%. This card is only available via our eligibility calculator. Capital One accepts some with a history of past defaults, County Court Judgments (CCJs) and bankruptcies.

All accepted get:

23mths 0% with 2.9% fee (27.9% rep APR after 0%)

All accepted get 12mths 0%. While this is shorter than the others, acceptance chances may be greater due to its lower minimum annual income threshold of £5,000. Fluid accepts some with past CCJs, IVAs or bankruptcies, provided they're over 3yrs old. You'll also need 12mths' UK address history and a UK bank account.

All accepted get:

12mths 0% with 3% fee (29.9% rep APR after 0%)

Try the credit card shuffle to cut interest

If you're unable to get any of the cards above (use our eligibility calculator to check), you may still be able to slash the interest and save money by asking for a low-rate or 0% deal on the card you already have.

If you've more than one credit card, you can then shift debt to the card which offers the lowest rate, though you'll need to factor in any one-off transfer fees.

Here's how to do it step by step:

List all your debts. Take stock of your current situation and note down all your existing debts, including an overdraft if you have one. Our credit card shuffle worksheet may help.

Check your account(s) for existing-customer offers. Lenders sometimes offer special deals (either a lower rate or 0% for a set period) for transferring new debt to your existing cards, though usually for a one-off fee. You can usually find these on your online account or by calling your card provider.

If you're paying debts at 18.9% APR on a credit card, and you can get a low-rate deal for 6.9% APR on another card you have, you could save about £120 interest in a year on a £1,000 debt.Shift debts to the cheapest card. Do a balance transfer to shift your debt from the card(s) charging the most interest to the one charging the least (or the cheapest ones, if your credit limit isn't big enough to allow you to move it to just one card). You could even consider shifting debt away from any card that will offer you a 0% deal for transferred balances. You can then transfer it back along with debt from other cards to get the 0%. Though be aware of balance transfer fees that could wipe out the gain.

Repay the most expensive debts first – the most crucial part. Once all your debt's as cheap as possible, relist them in the credit card shuffle worksheet. Then, focus as much cash as possible on the most expensive debt first and just pay the minimum repayments on any less expensive debts. Once that's repaid, shift focus to the next highest-rate debt... continue this until you're debt-free.

Quick credit card shuffle questions

What if I've debts at different rates on one card?

If you balance-transfer to a card at a special cheap rate, but already hold debts on it with a higher interest rate, the provider biases your repayments towards the higher rate debts first. This is good, as it means the most expensive balance disappears first (it used to be the other way around).

However, it means to get the absolute most out of the shuffle, there's an extra step to follow:

Only focus repayments until the expensive debt's repaid. Once you've done the shuffle, and you know the priority with which you should pay off each lump of debt, make sure you stop once all the expensive layer is gone. For example, if you had

Card A. £1,000 balance: £700 at 6%, £300 at 25% interest.

Card B. £400 balance at 18% interest.

You'd want to pay enough to clear the high-interest £300 first and then switch to clearing the £400, before finally paying off the £700. Though remember to always pay at least the minimum on the card you're not focusing on.

How much could I save doing the credit card shuffle?

The credit card shuffle needs careful management but if you follow the steps above, you could cut the total amount you have to repay by thousands.

Here's an example, showing the interest you'd pay doing a credit card shuffle vs not doing the shuffle:

Card & assumed credit limit | WITHOUT SHUFFLE | WITH SHUFFLE | ||||

|---|---|---|---|---|---|---|

Interest rate | Debt | Total interest (1) | Interest rate | Debt (2) | Total interest (3) | |

Card A £3,000 | 14.9% | £1,500 | £141 | 14.9% on existing debt, | £1,500 | £526 |

Card B £3,000 | 16.9% | £0 | £0 | 0% for four months then 16.9% | £3,000 | £235 |

Card C £2,000 | 19.9% | £500 | £23 | 19.9% | £0 | £0 |

Card D £5,000 | 17.9% | £5,000 | £1,784 | 17.9% | £1,000 | £31 |

Total | Avg rate = 17.4% | £1,948 | Avg rate = 14.1% | £792 | ||

(1) £100 monthly repayments on each card until card fully repaid. (2) All debt now balance-transferred; to do this, it was moved off the card and returned. (3) Repaying most expensive debt prioritised while paying minimum on other cards.

With normal debts of £1,500 on Card A, £500 on Card C and £5,000 on Card D, the average interest rate is 17.4%. Repay £100/month on each card and by the time you've cleared the cards in full, the interest totals £1,948.

Yet shuffle as much as possible on to Card A's 6.9% existing-customer offer for new debt and the rest to Card B at four months 0% then 16.9%, and then repay the most expensive debts first. This way the average interest rate is reduced to just over 14%, meaning the interest is only £792, less than half the cost – meaning a massive saving of £1,156.

Which debts should I prioritise?

It's all about interest rates here. Over to Martin...

The best thing to do is list all of your debts in order of the interest rate (APR) with the highest first. Then focus all spare cash on clearing that highest APR debt – as that's growing most quickly – and just pay the minimum on all others. For many people this will be the overdraft at first, as at 40% it's often more than double a high street credit card. So reducing your debt on it is the priority. Once you’ve cleared the costliest debt, shift your spare cash to the next highest APR, and so on. This way you’ll pay less interest and more of your money will be clearing the actual debt.

0% balance transfer credit card FAQs

Should I apply if my eligibility odds are, say, only 20%?

Martin says...

"Remember percentages are a clinical measure. A 50% chance means half those in your situation will be accepted. And while 95% seems almost certain, you can still be the 1 in 20 who doesn't get it.

My worry is many are wrongly put off by low odds. I often tell a tale of something that happened a few years ago, which may help...

I sat with a MoneySaver who had large, costly card debt and a poor credit history. Her eligibility showed zero chance of all balance transfers, except a 20% chance with Halifax. She looked despondent and asked me: "Is there any point?"

I explained that as it was the only credit she needed - there was no mortgage application or similar due - it didn't overly matter that a rejection would mark her file. The reason to protect your credit history is so you can get maximum use from it when needed.

This was her most pressing financial need, so a 20% chance was better than nowt. The worst that could happen was a rejection. She applied and got a 26mth 0% card with a £1,500 limit.

For more on this, and what you can do to improve things, see my related blog: Why you shouldn't worry too much about your credit score - it's not actually a real thing.

What if my credit limit isn't big enough?

The application is now on your credit file anyway, so make use of it. Use the new card to shift as much debt as you can to cut costs.

Once that's sorted, you can use our 0% Balance Transfer Eligibility Calculator again to see your chances of acceptance for other providers' cards. Though try to spread future applications out, as too many in a short space of time can hurt.

Can a balance transfer hurt my credit score?

Shifting a balance from one card to another isn't recorded on your credit file, so you're free to balance transfer as many times as you like. However, a footprint is added to your file every time you apply for a new credit card.

Multiple applications, especially close together, and high outstanding debts, even at 0%, can affect your ability to get further credit. See our Credit scores guide for full information. The most important preventative measures are to spread card applications out and use our eligibility calculator to check your chances of acceptance, before applying blind.

What if the eligibility calculator says ‘no chance’ for all cards?

It happens, especially if you’ve a poor credit history or lower income (see how to improve it in MSE's Credit Club). If your existing cards still have spare credit limit, see if you can shift debt from a high-interest card to a cheaper one — some providers even offer existing-customer balance transfer deals (eg, 12mths at 0%). If that’s not an option, focus on repaying debts in order of highest APR first — it saves you the most in interest. See our credit credit card shuffle for step-by-step help. If none of these are a goer, the priorities are repaying in the right order.

Can I transfer my partner's debt on to my 0% card?

Before you think about doing this, be aware that the debt then becomes yours. Even if you have an informal agreement between you that they will make the payments, the credit has been provided to you, so it's your responsibility to pay it off.

Make sure you think carefully before taking on your partner's debt – especially if you're feeling pressured to do it – as while you may be in a trusted relationship now, there's always a risk things could go wrong in future.

But if you're sure, some lenders allow you to transfer a balance from a card that's in someone else's name (as long as it's not with the same provider). At the moment, only Barclaycard and Nationwide allow this.

Can I shift debt to my existing cards too?

If you have spare credit limit, this is usually allowed, as Martin explains...

Yes and it's worth looking at. Some cards will give existing cardholders special offers (eg, 12mths 0% for a 3% fee), not as good as new customer deals, but useful, especially as it won't usually go on your credit file.

Even if you don't get a special rate, try and move all your debt to where it's cheapest. For example, if one is 18% APR, another 30%, ask the 18% card if you can shift debt from the other to it, it'll help. For a full step-by-step, see the credit card shuffle for how this all works.

Will transferring a balance close my old card for me?

No. When you transfer debt from one card to another the old card stays open, and you're able to use it if you wish – although if you're trying to pay debt off, it's usually not wise to keep spending on credit.

If you want to close your old card, you will have to let your old card provider know. Just not using the card or cutting it up doesn't close the account. Read full pros and cons of closing old credit card accounts in Should I cancel old cards?

I'm worried about debt. Is a balance transfer card right for me?

Getting a credit card is not always the right thing to do, and if you have a poor credit history or too much debt already, you might be rejected for one (or more) cards anyway.

If you're struggling to pay for your outgoings or meet your debt repayments, or are building up more debt just to pay for day-to-day living, getting another credit card could just add to any debt problems in the longer term. Our full debt help guide runs through the practical steps you can take if you're struggling with debt, including specialist resources and charities you can contact for free one-on-one debt counselling and advice.

Can I transfer a balance from an American Express (Amex)?

Yes, usually – but there are quirks. Amex cards have 15-digit numbers (not 16), so some providers’ systems can’t process them online (eg, Santander, Tesco Bank, TSB). In that case, call the new card provider, or try adding a “0” to the start or end of the card number.

Some lenders won’t accept Amex transfers at all – eg, NewDay (Aqua, Fluid, Marbles). Others have restrictions: Sainsbury’s Bank asks you to check first, and Virgin Money only accepts UK-issued Amex cards.

Other MSE credit card guides... What is a balance transfer credit card? | Find the right credit card | 0% money transfer cards | 0% credit cards for spending | All-rounder 0% cards | Debt help | How credit cards work | Travel credit cards | Student credit cards | How to pay off credit card debt more quickly | Prepaid cards

Why can you trust MoneySavingExpert?

MoneySavingExpert.com is the UK’s biggest consumer finance website, founded by Martin Lewis, offering impartial, research-based tips.

The site's dedicated to cutting your bills and fighting your corner with journalistic research, cutting-edge tools and a massive community – all focused on finding deals, saving cash and campaigning for financial justice.