Cheap car leasing

Find the cheapest long-term car rentals

A brand new car is never MoneySaving, but if your heart is set on one and you're comfortable renting it for a set period (without the chance to own it), then car leasing – also known as Personal Contract Hire or PCH – is worth considering. Here we've broken down the basics so you can work out whether car leasing is right for you.

What is car leasing?

Leasing a car is no different from leasing – or renting – anything else. For example, if you rent a house or flat, you pay a deposit, then you get to use it for an agreed period during which you pay a set amount each month. Once the contract ends, the property reverts back to the landlord.

And it's the same with car leasing. After agreeing how many miles you will drive each year, you'll pay a fixed monthly amount, often with a larger initial payment to act as the deposit.

Thankfully, most deals display this clearly. For example, a 24-month contract listed as 6+23 would mean the first monthly payment is six times the usual amount (so you'd pay £900 upfront in the first month, then 23 monthly payments of £150).

Most car leasing deals are for between two and three years on brand new vehicles, though it is possible to get agreements ranging from one to four years. Anything above this is rare.

You'll never own the car (or get the option to buy it) and at the end of the lease, it goes back to the finance company. It's inspected and, just like with a property, you'll need to pay out if you've damaged anything – though normal wear and tear is usually accepted. You'll also face extra charges if you've exceeded the agreed annual mileage.

There are two main types of car leasing: personal car leasing and business car leasing. This guide focuses on the former, though most of it applies to business leasing too.

What's the difference between car leasing and PCP?

The key difference is that Personal Contract Purchase (PCP) car finance allows you to take ownership of the vehicle at the end of your contract, while with car leasing you'll never own or get the chance to own the vehicle.

While with both PCP and car leasing you pay a deposit and monthly instalments to lease the car, PCP comes with the option of paying a higher 'balloon' payment to own the vehicle outright at the end of the deal. If you don't want to do this, you can just return the car to the lender.

Learn more about PCP deals in the alternative car finance section.

How does leasing a car work?

You'll usually lease a car from a finance company or sometimes direct from a manufacturer. Leasing used to be always arranged through a car dealership, but many leasing providers now operate online.

The deal they offer, and how much you pay, is based on the make and model you choose, how many miles you will do and how long you will keep the car.

The car remains the property of the finance company throughout, but as a brand new car quickly depreciates in value – accelerated further with time and higher-than-average mileage – it will be worth much less when you hand it back.

Most leasing companies sell the car on after you return it, so the leasing pricing model works by charging you an amount that covers the loss in depreciation (that's the price it bought the car for, minus what it predicts it can sell the vehicle for after the agreed term). It'll add on a bit for profit too.

Yet, as lease companies usually buy multiple cars at a time, they're often able to pay far less for a brand new car than individuals, so the amount of depreciation is usually lower. This can mean leasing deals for certain models can be competitive, offering a cheap way to get behind the wheel of a new car.

Who can lease a car?

To lease a car in the UK, you'll need to:

Be over 18. Even though the legal driving age is 17, you can't lease a car until you're officially an adult. This is because a car leasing agreement is a type of legally binding contract, and it's against the law for under-18s to sign contracts not deemed 'necessary'.

Have a valid driving licence. See if yours is still valid using our driving licence renewal guide.

Have a 'fair' to 'good' credit score. What a 'fair' to 'good' credit score means in practice depends on the credit reference agency you use, as each has its own scoring range. Learn more about this and how to find out your score for free using MSE's guide to checking your credit report.

Give personal information. Including name and address, employment details and financial information, such as bank details.

Provide documents. You'll also need to show the car finance company or manufacturer a form of ID, proof of address and a signed finance agreement.

Get car insurance. This is required once the lease is agreed. See more on car insurance below.

What are the different types of car leases?

As touched upon earlier, there are two main types of car leasing: personal car leasing and business car leasing. Let's look at the main differences between them:

Personal car leasing

For an individual. It's an agreement for one person, as opposed to a company.

Payment responsibility. The lease agreement is in the individual's name, meaning they're responsible for the monthly payments.

Tax implications. Personal lease payments are typically not tax-deductible.

Low mileage limits. Individuals tend to get lower mileage limits on car leases than businesses seeing as they typically will cover lower distances.

Business car leasing

For a business. Business car leasing is intended for companies and their employees who need cars for business-related activities.

Payment responsibility. The business is typically responsible for lease payments, with the agreement in the company's name.

Tax implications. Businesses are usually eligible for tax deductions on car lease payments, as the cars are considered a business expense. They also tend to get higher mileage limits, as explained above.

Limited personal use. To reclaim VAT on a business car successfully, personal use must be kept to a minimum.

Not the car finance option you were looking for? Check these out...

Personal car loans | Hire Purchase | Personal Contract Purchase

Also see: Compare personal loans, Car finance vs bank loan and Buying a car

How much does it cost to lease a car?

The average cost of leasing a car varies massively, with a ballpark estimate being anywhere between £100 and £1,000 a month. How much it sets you back depends on aspects including:

The car you buy. You can lease cars made by many manufacturers, including Citroën, Dacia, Hyundai, Kia and Skoda. However, a high-end car from the likes of Audi, Cupra or Tesla is going to cost you more each month than a more budget-friendly Fiat or Vauxhall vehicle, as you might expect.

The initial rental. How much you spend upfront will massively affect your monthly costs. The more of the total lease cost you cover initially, the less you owe overall, lowering your monthly repayments.

The length of the contract. If you opt for a longer lease agreement, the total cost of your car hire will be spread out over a greater period, resulting in lower monthly repayments. However, this does mean that you'll be tied down to a contract for longer.

The agreed annual mileage. The higher annual mileage you agree to, the larger your repayments will be, because big miles speed up the car's depreciation. As a result, the finance company or manufacturer leasing it to you won't be able to fetch as much when selling the car later down the line.

In addition to the monthly lease payments, you'll also be liable for costs such as car insurance and any damage or excess mileage charges at the end of the contract.

Leasing vs buying a car: Which is cheaper?

As cars almost always depreciate, you could say they're never a good investment. But if you buy a car you'll at least be able to sell it and get some money back when you want to change it. It's different with leasing as you know from the outset that you'll be left with nothing at the end of the contract.

The key question is therefore whether the amount you'd pay over the duration of the lease is higher or lower than the amount you'd lose by owning the car and reselling it over the same period (so the price you'd buy it for plus any interest costs if you needed to borrow, minus the price you'd expect it to sell for).

If it's lower, leasing would be cheaper than buying, plus you won't have cash tied up in the car as you'll just need to keep up with monthly payments. If it's higher then you'd be better off buying the car.

What are the benefits of leasing a car?

Whether leasing a car is right for you will come down to your personal circumstances – we go into some of the key considerations in the alternatives section below – but here are some of the main benefits of leasing a car:

-

Lower monthly charges. Lease payments are generally lower than other forms of car finance.

-

Fixed payments. Monthly lease payments are fixed, making it easier for you to budget.

-

Smaller deposit. Car leases typically involve a smaller down payment in comparison to buying a car using other methods.

-

Reduced ongoing costs. Since many leased cars are under warranty for the lease term, you're likely to have lower repair and maintenance costs compared with owning a vehicle outright. Also, lease companies often cover road tax costs, and, if the car is less than three years old, you won't need to MOT it, saving this additional outlay.

-

Access to newer cars. Leasing gives you flexibility to grab the latest models with the newest features and tech every few years – without a long-term commitment.

Of course, leasing a car does come with drawbacks too. These include being unable to own it outright, fees for things such as excess mileage and excess wear and tear, and often being more expensive overall than buying a car in the long-run.

What are the alternatives to leasing a car?

This guide focuses on leasing, though before you go on, do check these alternative types of car finance to assess if they'd suit you better.

Broadly speaking, there are six main ways to pay for a car. The table below has the key differences at a glance, then we run through the alternatives to leasing in more detail, with links out to our other car finance guides where relevant.

Finance type | Typical length of agreement? | Initial deposit required? | Who owns the car? | Mileage restrictions? |

|---|---|---|---|---|

None – cash savings | N/A | N/A | You | No |

0% credit card | Up to 23 months | No | You (though you'll still need to repay the debt) | No |

Personal loan | Usually 1 to 7 years | No | You (though you'll still need to repay the debt) | No |

Personal Contract Purchase | Usually 1 to 5 years | Yes (i) | The finance company, unless an optional final balloon payment is made | Yes (ii) |

Hire Purchase | Usually 1 to 5 years | Yes (i) | The finance company, until the final repayment is made, then you | No |

Leasing/Personal Contract Hire | Usually 1 to 4 years | Yes (i) | The finance company, at all times | Yes (ii) |

(i) In most circumstances, though sometimes you can get a deposit contribution from the dealer or structure a lease deal to pay nothing upfront. (ii) You'll usually agree an annual mileage limit with the finance company at the start of the deal & will pay additional fees if you are over this when handing back the car.

Sadly, there's no 'one-size-fits-all' answer to which wins (as much hangs on whether you want to own the car and other factors). However, we've included more information on each alternative to car leasing below, to help you work out which is right for you.

Cash savings – the cheapest option for most cars

The clear winner if you want to own the car fully from day one, as you'll avoid paying any interest or taking on debt. Though if you're looking to buy a brand new car – which on average loses about 40% of its value by the end of the first year – and are likely to change it in the next few years, it's worth considering leasing or a Personal Contract Purchase deal. With these, the overall cost of ownership can work out cheaper.

0% spending credit card – no interest if you can get a big enough credit limit (and the dealer accepts cards)

Depending on the price of your new car, a 0% spending credit card could be the next cheapest way to borrow. You'll own the car outright (like paying in cash) plus you'd be covered by Section 75 protection. However, you'd need to check whether the car dealer accepts payment by credit card, as not all do.Unfortunately you usually won't know what credit limit you'll get before applying, and you should budget to pay the debt off before the 0% period ends, as the interest rate rockets after then. The longest cards typically offer up to 21 months at 0% interest – see our 0% spending cards guide for more information.

Personal loan – usually cheapest if you need to borrow and want to own the car outright

This won't be at 0%, but may allow you to borrow more and over a longer period than you'd get on a credit card. Repayments will be structured for you to clear the debt at the end of the term, which is usually between one and five years.Using a loan to buy the car means you'll own it outright. See our Cheap loans guide for the best buys and full help.

Personal Contract Purchase (PCP) – can be good if you want a new car every few years, but often more expensive overall than a loan

This is a popular way to get a new car, especially if you frequently change vehicle and want to pay for it monthly. It's basically a loan, though usually cheaper each month as you won't be paying off the full value of the car. You also won't own it at the end, unless you choose to.

You'll pay a deposit and then monthly instalments over a set term. There's usually a mileage allowance, but provided you stick to that and don't damage the car, you can either return it and walk away at the end of the agreement, or pay what's known as a 'balloon payment' to own it.

As the dealer will be making money from the finance deal, you may find it offers larger discounts or contributions to the deposit on new cars. For used cars, it may mean you can haggle more off the sale price. Always be careful and make sure to calculate the total cost you'll need to repay after all interest has been added. This will then show the 'true' value of the discount. See our Cheap Personal Contract Purchase guide for more information.

Hire Purchase (HP) – an option if you're struggling to get a cheaper loan, though the lender owns the car until you've made all the repayments

This works in a similar way to a loan – as you're borrowing and paying off the full cost of the car – though here you won't own it until you've made the final payment. Instead the car is owned by the finance company as it uses it as security against the loan (like a mortgage), so if you fail to pay, it can seize the car.This security can mean an HP deal will be easier to get than normal loans, though you'll usually need to pay a deposit (often 10% or more of the car's price). You'll therefore need to consider how to fund that.

Like with PCP above, the dealer will be making money from the finance deal, so it may offer larger discounts or contributions to the deposit on new cars. For used cars, this may mean you can haggle some money off. Always be careful to calculate the total cost you'll need to repay taking into account all interest. This will show the 'true' value of the discount. See our Cheap Hire Purchase guide for more.

Car leasing need-to-knows

If you think car leasing is right for you, here are the need-to-knows to understand before opting for a new agreement.

You'll never own the car, and when the lease ends your only option is to hand it back (or possibly extend it)

Once you've reached the end of your contract, you'd usually arrange for the car to be collected and returned. However, you may be able to extend the lease – it's worth contacting the finance company a few months before the end of the lease to check whether it will allow this, and whether it will offer a discount on the monthly payment as the car is now older.

When you're returning the car, the finance company will arrange a time for it to be collected and inspected. Providing it's in good condition with no damage (aside from normal wear and tear) and within the agreed mileage, then there'll be nothing else to pay.

You'll pay hefty fees at the end if you damage the car or exceed the annual mileage allowance

When the car is collected and inspected, any damage will usually be pointed out to you and recorded in a report. If there's damage beyond fair wear and tear (for example large dents, scratches or broken parts), you should receive a bill to cover the repair charges.

Once the car has been returned you no longer have any option to get other quotes, so it's worth getting any major damage repaired before the inspection, allowing you to do the repairs more cheaply.

Similarly, if you've gone over the agreed mileage limit, you'll need to pay a charge – usually about 10p per mile (check your exact charge per mile before signing the lease).

Avoid these charges by agreeing a sensible mileage upfront and taking good care of the car. Always request a copy of the dealer or finance company's fair wear and tear policy at the start of the agreement, so you know what fees to expect.

Though you won't own the car, you're usually responsible for insurance, parking/speeding tickets and general upkeep (for example, servicing)

The leasing company remains the legal owner and registered keeper at all times. This means that it will pay road tax on your behalf – plus any parking fines or speeding tickets you receive. However, all of these costs will be passed on to you (road tax will be accounted for in your monthly payments), sometimes with an admin fee on top in the case of an infringement.

You'll also be responsible for servicing costs and insuring the car, so factor these in on top of your monthly payment.

It's likely you'll be offered the option of adding a maintenance package to the deal, which you'll pay for monthly. Policies vary, but will usually cover annual servicing and replacement tyres.

Before signing up, get an idea of servicing costs separately, so you can make a fair comparison, especially as new cars typically don't need servicing in the first year. Also bear in mind that most faults will be covered under the manufacturer's warranty anyway.

You'll usually need comprehensive car insurance (and provide proof)

It's usually a requirement of the lease to have comprehensive cover in place, and you'll usually need to provide a copy of your insurance certificate before taking delivery.

As soon as you receive the registration details and have a confirmed delivery date, it's a good idea to get a quote as soon as possible as policies tend to be more expensive if you take them out a day before the insurance is required (the cheapest time is about three weeks before). See our Cheap car insurance guide for full help and information.

You can usually end the agreement early, but it's often costly

If you think you may need to end an agreement early, always check the fine print before you sign up, as not all leasing providers allow this.

Even if it does, it's usually a very expensive option as the leasing company will be trying to cover its potential losses.

The lease agreement is calculated to cover the loss in depreciation (the price the company buys the car for, minus what it predicts it can sell the vehicle for after).

As cars depreciate much faster in the first year of ownership, handing the vehicle back early often means it's already lost the majority of value, so is worth much less than the leasing company will accept.

So it will charge an 'early termination' fee, usually a lump sum – typically about 50% of your outstanding payments, though it varies by lease so always check. For example, to quit a two-year lease at £200 a month after one year, you'd need to pay £1,200. This is often in addition to any damage or excess-mileage charges.

You normally need to pass a credit check, and could lose the car if you miss payments

When you apply, the lender will do a credit check to decide whether to lend to you, and this check will appear on your credit file as an application for credit.

Credit checks for leasing aren't usually as stringent as those for personal loans. This is because the finance is secured on the car – if you don't pay, the lender can just come and repossess the car, whereas for loans there's no security, so it'd need to chase you through the courts.

If you find you're not able to make repayments, always contact the lease provider – ideally before the next payment is due. If it knows you're struggling, it should help you by offering an alternative and affordable repayment plan.

If you miss a payment, it's likely the lender will contact you to see what's wrong. If you keep missing payments, it'll mark you as in 'default'. Once this happens, it'll usually take back the car quite quickly, as to leave the vehicle with you while it chases payments risks the car's value depreciating even more.

As well as the company taking the car, if you fail to keep up repayments, you'd get a default mark on your credit file, which could affect your ability to get a mortgage or other credit. See our Credit scores guide for more info.

Pay the deposit with a credit card (even just 1p) for valuable protection – for cars worth up to £30,000

You don't need to pay every monthly payment on the card. Just put some of the deposit, even as little as 1p, on a credit card, and you get powerful extra protection if something goes wrong down the line. This is because you're then covered by Section 75 laws.

Provided that the total cost of the car you're buying is between £100 and £30,000, paying anything towards it by credit card means the card company (or finance company in some cases) is equally liable along with the dealer if things go wrong.

However, this isn't always straightforward. Some dealers don't accept credit cards and some may only allow you to pay a limited amount by card. So figure out how important this is, and ask your chosen dealer if it can accept cards before deciding how to pay.

If you need to borrow to pay for the deposit, a 0% spending card is the cheapest way as, done right, there's no interest. For full help and top picks, see Best 0% spending cards.

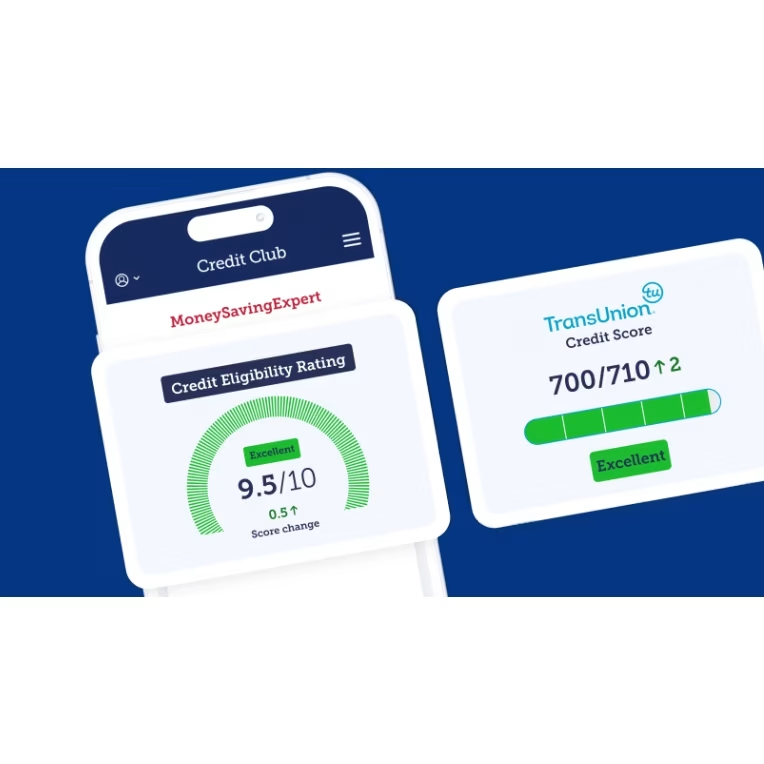

MSE's Credit Club

MSE's Credit Club

MSE's Credit Club shows your real-world credit power – which translates to acceptance for credit cards, loans & more – and explains how to improve things.

MSE's Credit Club uses a new Eligibility Rating which combines the THREE crucial factors that dictate whether a lender will accept you, to show a far bigger picture...

1) Your credit score.

2) Your affordability score (which, crucially, includes income).

3) Current market conditions.

Once logged in, you can also use our Credit Cards Eligibility Calculator to see which cards you'll most likely be accepted for, without impacting your ability to get future credit.

It'll also show your credit report and other related info, plus gives access to our eligibility calculators for loans and mortgages.

How do I compare car leasing deals?

To help find the best car lease deals, there are a host of comparison sites, which scan hundreds of offers from dealers and brokers across the UK. There are two types of deal:

Stock cars, where the car is already in the UK and is usually delivered within a few weeks (and cannot be customised).

Factory orders, where there's often a few months' wait as the car is yet to be manufactured. This is best if you're looking to change the spec or add optional extras such as a panoramic roof.

Don't be put off if the cheapest dealer is miles away, as it will arrange free delivery to your home address and you'll be able to take the car to any franchised dealership for servicing or if anything goes wrong. If you'd still rather use a local dealer then it's worth taking the best quote along to see if it will match or beat it.

How to find the cheapest car leasing deals

You can search hundreds of car lease deals online, whether by putting in a specific model, your budget, your preferred contract length or even the type of car you're after, such as SUV, convertible, hatchback or hybrid. To help find the best deal, follow these pointers:

Compare using the TOTAL COST over the entire contract. Don't be distracted by low monthly payments – this often disguises a large deposit. It's the total cost that matters. Multiply the monthly payment by the number of months in the deal, plus any larger deposit and fees. So for a 6+23 £150 a month deal with a £199 processing fee, you'd pay a total of £4,549 over two years (29 x £150 + £199).

You can then compare this against other lease deals over the same term or different types of finance. Plus, if this is higher than the amount you'd expect the car to lose in value if you bought and sold the car yourself, then it's likely not a great value deal – and vice versa.

Play around with the contract length – some deals are only available on certain terms. There's no set rule for which period is cheaper (for example, we've seen two-year deals work out cheaper per year than four years).

Be realistic with your expected mileage. Here, more miles will almost always return a more costly deal – though you need to set an allowance you can stick to or you'll just be stung with charges at the end.

Here are our top-pick comparison sites, chosen for their ease of use and listed in alphabetical order – it's best to combine them for the broadest range of deals.

Comparison site (in alphabetical order) | Why we like it |

|---|---|

LeaseLoco.com* first lets you home in on cars within your monthly budget, then lets you filter deals based on your preferences. It has a 'Loco Score' to help you figure out if the deal's good value for money, but offers no way to sort by total cost. You'll need to manually add the initial payment to the monthly payment multiplied by the lease length to get this figure, so it's trickier to compare. | |

Leasing.com* shows all car deals for your budget (or by make/model) plus you can sort by total cost for true ease of comparison. It also has a nifty value rating to give an idea of how the lease compares with the depreciation of buying and selling the same car over the same period, which can be handy to identify standout special deals – though it's not an excuse to exceed your budget. | |

Moneyshake.com* allows you to sort by monthly cost or total lease cost which gives a fuller picture of what you'll have to pay including fees. However, you’ll need to enter your contact details in order to proceed with taking out the lease, as this is done over the phone rather than online. |

What happens once I've found a car leasing deal?

You can contact the lease provider through the comparison site, though it's also worth checking to see if it's any cheaper by going direct. You can usually just search for your chosen provider's own site, and check the deal there.

You normally can't do the whole process online, so you'll often need to send an enquiry on your chosen car, or ask for a call back. The provider will then take your details, run a credit check and take payment for any processing fee that's applicable. You'll then be notified once the vehicle is ready and be sent registration details of the car so you can sort comprehensive car insurance. You'll then just need to arrange a convenient delivery date.

When the car is delivered, take your time to inspect it inside and out, and make sure it is free from damage or marks. If you find anything, ensure it's noted down before signing to accept it, otherwise you'll be responsible for it when returning the car.

Want to complain about your car finance provider?

If you think your car finance agreement was mis-sold to you, see our dedicated guide on how to reclaim car finance.

Alternatively, you can also complain if your car finance provider has taken the wrong amount in payment, treated you unfairly or its service has been atrocious. It's always worth trying to call the lender first to see if it can help, but if not...

You can use free complaints tool Resolver. The tool helps you manage your complaint, and if the company doesn't play ball, it also helps you escalate your case to the free Financial Ombudsman Service.

Car leasing Q&A

How much is a car lease per month?

You'll pay an initial deposit, then a set amount every month for a set period, usually two to four years. The higher the deposit you opt to pay, the lower the monthly payments will be, though the exact values vary significantly based on the make and model you choose.

Roughly speaking, for an entry-level small hatchback, lease deals start from about £120 a month, with a deposit six to nine times that (so £720 to £1,080), over a four-year deal. For expensive premium cars, monthly payments can go into the £1,000s.

Whichever model you choose, the key figure for comparison is the total cost, as this factors in the initial payment. A low monthly payment may look appealing, but if you need to pay a hefty amount upfront, you could find yourself shelling out more overall.

How do I estimate my mileage?

What mileage you need to put down really depends on how much you think you will drive the car. Will you just use it as a runaround on the weekend or will you be driving to work? Let's take an example...

Anne works Monday to Friday and wants to drive to work every day. She works 10 miles away – this means she will be doing at least 100 miles a week. Taking into account four weeks' holiday a year, she will be doing 4,800 miles a year just driving to work. And that's before taking into account weekend car journeys and any holiday driving.

So, for Anne, it's probably worth estimating that in an average year she'd do 6,000 to 8,000 miles. It's always best to have some leeway in your estimate.

Will insurance be included in the lease deal?

The leasing company will provide the car, but you'll be responsible for taking out car insurance. It's usually a requirement of the lease to have comprehensive cover in place, and you'll normally need to provide a copy of your insurance certificate before taking delivery.

As soon as you receive the registration details and have a confirmed delivery date, it's a good idea to get a quote as soon as possible as policies tend to be more expensive if you take them out a day before they're required, than, say, three weeks before. See our Cheap car insurance guide for full help and information.