Credit scores

Top tips to boost your creditworthiness

Everyone should take time to manage their credit report and score. Your credit report is vital – it's not just about whether you can get a mortgage, credit card or a loan, it can also affect mobile phone contracts, monthly car insurance, bank accounts and more. Here's all you need to know about credit checks.

Important. This guide was originally written by MoneySavingExpert.com founder Martin Lewis, but it is now regularly updated by the editorial team.

Watch Martin's five-minute credit scoring tips video

For a quick overview of the top credit scoring tips, first watch MoneySavingExpert.com founder Martin Lewis's five-minute introductory video.

This clip has been taken from The Martin Lewis Money Show Live on Tuesday 30 January 2024 with the kind permission of ITV Studios. All rights reserved.

What is a credit rating and credit score?

A credit rating shows how likely a typical lender would be to offer you credit.

When you apply for credit – such as a loan, credit card or mortgage – the lender tries to predict your future behaviour based on the way you've acted in the past. Credit scoring is fairly intuitive – just think whether you'd lend to someone with a history of not repaying?

To work it all out, lenders look at lots of different data. This may include how many applications you've made recently, how much you owe, what credit products you've had and whether you paid them all off on time. Some of this comes from their own information, but often they'll also consult credit reference agencies Experian, Equifax or TransUnion, which hold much of this data on you.

But the world of credit ratings is rife with misinformation and misunderstanding. Much of it is because lenders don't want it understood, and credit reference agencies want you to think it works a certain way so they can sell you extra products based on fear.

This jargon buster should help you navigate the world of credit ratings and scores:

Credit reference agencies: Three credit reference agencies – Experian, Equifax and TransUnion – hold tons of info about your past behaviour, such as your payment history to credit card, loan and mortgage firms, your past applications for credit, and whether you're on the electoral roll. Lenders use this data to help them decide whether to grant you credit.

Credit history: This is your past behaviour with credit, such as whether you've paid lenders back on time. It is not a numerical verdict, instead it's the term for a more general look back.

Credit report or credit file: This is the compendium of your data as held by each of the three credit reference agencies.

Credit score (specifically from a credit reference agency): As mentioned above, this is simply a view from one agency, which remember is not the decision maker on whether you'll get credit or not. Lenders use their own scoring systems.

Credit score or credit rating (where we're not talking about a score from a credit agency): In this context it can also be used interchangeably in casual speak with credit history. But technically speaking, it is how each lender sums up your credit history with its own score or rating. As it's so secretive we don't know if lenders use numbers, rankings or other means to judge customers. Whatever they use, it applies just to that lender and is not used market-wide by others.

IMPORTANT: Your credit history impacts your creditworthiness but you DON'T have a uniform credit score or credit rating

Don't fall for the misconceptions – in the UK, there's no one credit rating or score that is a market-wide judge of your creditworthiness, and there's no blacklist of banned people.

While individual credit reference agencies may give you a score, that is simply their view of your history, sometimes as a means to sell you that verdict as part of a subscription service. Yet the agencies just collect data that they share with lenders. It's lenders that make decisions whether to give you credit and each lender scores you differently and secretly, and their scores are far more important.

Here are our ten other credit rating need-to-knows:

-

Credit scoring is about predicting future behaviour

This isn't easy if you have little or no credit history. When you apply for a product, a 'credit check' is done. In practice, this means lenders put all the data they have on you into a complicated algorithm. It's an attempt to predict your future behaviour based on what you've done in the past.

While a poor history counts against you, so does having little credit history as it makes predictions less certain.

Imagine you are lending someone money. On the surface, they may appear trustworthy. But if you don't have much info about them, you'd want to know more, just to be sure.

That's why one of the key challenges for some is to build a credit history – though it's not easy if no one will give you credit.

If you're one of the UK's five million credit 'invisibles' in that situation, you can find help on how to build your credit history. It's aimed at students and the young, but the theory applies to everyone. If you're currently a student and want to understand more about student loans and your credit file, see Student credit scoring.

Struggling to understand credit scoring? Play my 'would you lend to someone who' quiz by watching the video below

'Would you lend to someone who' quiz

'Would you lend to someone who' quizThis clip has been taken from The Martin Lewis Money Show Live on Tuesday 30 January 2024 with the kind permission of ITV Studios. All rights reserved.

While its complicated at its edges, in the main credit scoring is pretty intuitive. It's all about trying to predict future behaviour based on the past. So lets play a wee game, in all cases...

At the pub, someone's forgotten their cards, and asks you to lend 'em a tenner, saying they'll pay you back. Would you if:

a) They often do this, yet EVERY time, have always repaid you or others back promptly the next day?

b) They often do this, yet very rarely remember to pay you back, without you hassling them a lot?

c) They seem nice but, you've not met them before, nor have any of your friends?

Our instincts would be warmest to the first, and coldest to the other two. If you're similar, then you've been credit scoring...

a) Is someone with a good credit history

b) Has a poor history

c) Is someone you have too little data on, so rejectPrefer to read rather than watch?

Quick question:

Unfortunately, if you're new to the UK – even if you built up a really good credit history in the country you lived in before – you'll essentially be starting your credit history again, as credit scores can't cross borders. This'll also be the case if you're emigrating from the UK to another country.

In the UK, the credit reference agencies Experian, Equifax and TransUnion build credit reports using information from UK accounts only, so if you've just moved here, you'll probably find that your report looks quite bare, which'll impact your ability to get credit.

For this reason, it's important to start building your UK credit history soon after arriving in the country. Do keep copies of your credit history from abroad though, as with some lenders it could help with your application (and vice versa if emigrating from the UK).

If you're in this situation, see our Build your credit history guide.

I've recently moved to the UK – does my history from abroad count?

-

It's as much about 'will you make the lender money' as it is about risk

Many people write to us incensed after rejection – "I've a perfect credit score, I've never missed a payment, why on earth did they reject me?". This is based on a misunderstanding – lenders are credit scoring to see if you match up to their wish list of what makes a profitable customer.

Of course, someone who is a bad risk is likely to be scored out as unprofitable by most companies. But the risk of not repaying isn't the be-all and end-all.

Imagine a bank wants new mortgage customers. That's a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you're likely to be a profitable mortgage borrower in future – you might face rejection if you aren't.

The secretive nature of credit scoring makes this difficult to ever truly know. You may also face a decline if you're unlikely to make the credit card much money...

Pay off in full every month, don't use your cards enough, or always shift debt to 0% cards? You might feel like a dream punter, but for credit card companies you're a nightmare. If they spot this trend, you could be rejected. Profitable customers are those perpetually in debt, never defaulting, but always meeting the minimum repayment.

DON'T use this as an excuse not to pay off your credit card in full, especially if you don't have a 0% card (though you really should). For more info, see our Best balance transfer credit cards guide.

-

What lenders really know about you

It's important to be aware of exactly what lenders know when you apply, so you can present yourself in the best light. Importantly, it's more than just what's on your credit file.

-

The application form. In many ways this is the most important part. Here, lenders obtain the key details: your postcode, salary, family size, reason for the loan and whether you're a home owner.

Make sure you fill in the forms carefully. One slight slip, such as a "£3,000" salary rather than a "£30,000" one, can kibosh any application.

Be consistent too. Fraud-scoring firms filter applications and if there are many inconsistencies – such as changing your job title or different phone numbers, it can cause a problem that you may not be told about. -

Past dealings you've had with the lender. Companies use any data on previous dealings they've had with you to feed into the credit score. This means those with limited credit history may find their own bank more likely to lend to them than others.

Of course, those who've had problems with a lender in the past may find it more difficult to get accepted there too. -

Equifax, Experian and TransUnion credit files. The three UK credit reference agencies compile information, allowing them to send data on any UK individual to prospective lenders. All lenders use at least one agency. This data comes from four main sources:

-

Electoral roll information. This is publicly available and contains details of addresses and who lives at them.

-

Court records. County court judgments, decrees, individual voluntary arrangements, bankruptcies and other court debt orders indicate if you have a history of debt problems.

-

Search, address and linked data. This includes records of other lenders that have searched your file when you've applied for credit, addresses you're linked to, or other people you have a financial association with.

Big gas and electricity firms do hard credit checks – these go on your file too. -

Account data. Banks, building societies, utility companies and other organisations use credit reference agencies to share details of all your account behaviour on credit/store cards, loans, mortgages, bank accounts, energy and mobile phone contracts from the last six years.

About 350 million records a month are tracked. The first type of information and the most common is 'default data', which shows where you're officially in default and haven't paid money you owe.

Some lenders share 'full data' too. This can incorporate how you generally operate the account, from being the model customer to defaulting. Some credit card providers share the amount you repay too (if it's the minimum, or if you repay in full) and whether you've a promotional deal (plus if you use credit card cash advances). This helps lenders weed out those just playing the system.

In addition, payday loan data is normally reported, while doorstep lenders are legally obliged to share the data that they hold on you. -

Buy now, pay later (BNPL) use. At the moment, most BNPL agreements don’t affect your credit score 'number' from Equifax, Experian or TransUnion (Zilch is an exception). However, some BNPL providers are beginning to report to these credit reference agencies already – meaning BNPL agreements can appear on your overall credit report.

This will start to become commonplace as the BNPL sector becomes regulated from July 2026. And, as part of certain applications, lenders may use open-banking data or ask to see bank statements, which will also show any use of BNPL. See more on BNPL below. -

Some history from energy/phone providers. If you look to switch energy provider, or change from a prepayment meter to a normal credit meter (where you get a bill), it's likely to leave a footprint as many providers now share credit report data.

-

Fraud data. If you've committed fraud (or someone has stolen your identity and committed fraud), this will be held on your file under the CIFAS section.

Plus, see what lenders and credit reference agencies DON'T know about you below.

-

-

What lenders don't know – ignore conspiracy theories

Many people believe every element of their life is on their credit reference files, but actually it's mainly just a strict set of financial data. Though over recent years, the information contained on them has grown.

So let's debunk some myths. Here are a few of the more common things people think are on their files, but aren't.

-

Your credit score. The three credit reference agencies, Experian, TransUnion and Equifax, have individual ways of scoring you, meaning the numbers you see may be different for each one. Interestingly, lenders don't see this score at all – it's just for you.

-

Race, religion, ethnicity. These personal details about you are not held.

-

Who you're married to or living with. Provided you don't have any joint financial products and are therefore financially linked, there's no information about family members who live, or have lived, with you or any other third parties.

-

Medical record. Medical problems you may have had in the past aren't listed.

-

Salary. How much you earn isn't on your file either, though you'll usually be asked on the application form.

-

Savings accounts. As savings are not a credit product, they don't appear on credit files. This data is therefore only available to banks you hold savings accounts with. However, when you apply for a savings account, the provider might do a soft search of your credit report to check your ID, and do anti-money-laundering checks.

-

PPI, bank charges & other reclaims. If you've attempted to, or have successfully reclaimed PPI or bank charges, it won't appear on your credit files.

-

Student loans (except pre-1998 starters). Unless you've had a county court judgment against you for lack of payment, no information about 'income contingent' student loans – the type all those who started university since 1998 have – is passed on to the credit reference agencies by the Student Loans Company (see Should I repay my student loan? for a full briefing).

Those who started university pre-1998 and have old style 'mortgage' type student loans have both defaults and county court judgments recorded with the agencies. -

Soft searches. Some lenders (and MSE's eligibility calculator) will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn't passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It's not always clear, but the words "administration check" or "quotation search" should indicate something, but lenders can't see this – so it doesn't play any role in any assessment of you. -

Criminal record. No criminal convictions are listed.

-

Council tax arrears, parking fines or driving fines. Councils don't share data about your payments, whether good or bad. If you're in arrears, it won't affect your credit score. Yet it's wise to prioritise your council tax payments as many councils are quick to prosecute. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Any fines you've incurred, like a parking or driving fine, won't be listed. Even though they're issued by the courts, they aren't 'credit' issues.

-

-

Your credit report dictates the product and rate you'll get

These days the credit landscape is all about 'rate for risk'. This means almost every credit provider on the market uses your credit file to not only dictate whether they'll provide you with credit, but also what interest rate you'll get.

The most obvious way this manifests itself is in representative rates on loans.

Here, only a minimum of 51% of accepted customers must get the rate advertised. They might be advertising a 6% rate (known as the representative APR). But you could be accepted and offered a 40% interest rate instead, because of a poor credit score.

It applies to other products too. Some 0% credit cards give you a shorter 0% period if you've got a poor credit history (assuming they'll accept you), others will simply offer you a different product to the one you've applied for. This is why it's so important to manage your creditworthiness.

-

Don't panic if your credit score drops slightly with one of the agencies. It's actually what's on your credit report that matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it's a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

-

Your application details. For example, your salary.

-

Any past dealings you've had with that lender. For example, old accounts.

-

The info contained in your credit reference reports.

Yet the first two aren't factored in to your credit score – so it's based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own 'ideal customer' scorecard – and each lender is different. Just because one lender rejects you doesn't mean another will do the same. So bear in mind:

-

Rather than thinking "I have a great credit score so I'll get any credit I apply for", it's actually best to check how you stand with different lenders before you apply. A way of doing this is to use our credit card and loan eligibility calculators. That way, you'll have a better indication of which lenders are likely to accept you (and there's no impact on your ability to get credit, as there would be if you applied directly).

-

If you get lots of high percentages then you're doing reasonably well – but NO ONE is ever likely to be accepted for every card or loan. If our calculator shows you're not likely to be accepted for many cards or loans, see our tips to boost your creditworthiness.

The impact of a slight credit score drop is near meaningless

For those looking at their score and wondering 'what is a good credit score', it's helpful to understand that each of the credit reference agencies has a different scoring range. These are as follows:

- Experian: 0-1,250 (previously 0-999, but changing from mid-November, with everyone moved over by the end of the year – see more on what the change means)

- Equifax: 0-1,000

- TransUnion: 0-710Where the top credit scores are 1,250, 1,000 and 710 respectively, zero is theoretically the lowest score – though in practical terms it's impossible to get. If you've got no or little credit history, your score won't be zero by default, rather, your credit score simply won't exist (it'll only be generated if you go on to apply for credit).

These scoring ranges are the same even if you're not accessing your score directly from the credit reference agency itself – for example, you're using MSE's Credit Club to check your TransUnion score, or Clearscore to check your Equifax score.

Anyone with a credit score should consider it inevitable that their score will drop or fluctuate at some point. This shouldn't be a cause for panic though, especially if it's only a slight dip. In general, the impact of your score going down a small amount is near meaningless. Have a watch of this video to see why:

MoneySavingExpert.com Martin Lewis explains what to do if your credit score drops

MoneySavingExpert.com Martin Lewis explains what to do if your credit score drops -

-

'I am not a number, I'm a free man!' Er, not with credit scoring

We don't have a right to be lent money. While the Government pushes lenders to offer more credit, especially in the small business and mortgage worlds, ultimately it's still a commercial decision from firms about whether they want to lend.

This is done with a massive system of automated impersonal credit checks. It's often far cheaper for a lender to reject some people who it should be lending to than it is to accept some it shouldn't be lending to.

You may feel it's unjust, but The Prisoner's call – "I am not a number, I am a free man" – doesn't work in credit scoring. Here you are just a number, and you have to understand that, as frustrating as it may seem.

-

There are three main things lenders look at when deciding whether to lend to you

Prefer to watch? MoneySavingExpert.com founder Martin Lewis explains the three main things lenders consider when deciding whether to accept your application...

Martin Lewis explains how lenders actually analyse whether they will accept you

Martin Lewis explains how lenders actually analyse whether they will accept you(From The Martin Lewis Money Show, Tuesday 30 January 2024. With the kind permission of ITV Studios. All rights reserved.)

Understanding the three main categories lenders use to make a decision can help you get to grips with how lenders are likely to view you.

1. Debt ratio

This is the percentage you owe compared with your annual income. In general, the lower the debt ratio, the better. This is for non-mortgage debt such as cards and loans, for example, £10,000 of card debt on a £40,000 income is a 25% debt ratio.

This is broadly how lenders view debt ratio:- under 20% = EXCELLENT

- 20% to 40% = GOOD

- 40% to 60% = OK

- over 60% = BADTo improve it: If possible pay off more of your debts (or increase your income, though if you could, you'd probably be doing that anyway). Yet lenders do like to see a little debt used, so they can check you're doing it responsibly and paying it off – so a ratio under 1%, especially if you've little other credit data, can be viewed negatively.

2. Credit utilisation

This is the percentage of your available credit that you’re currently using. For example, if the total amount you can borrow across all your credit cards is £10,000, but the total of what you owe is £1,000, your credit utilisation is 10%. But were the amount you owe to increase to £5,000, your credit utilisation would be 50%.

To improve it: Lenders broadly see credit utilisation using the same scale as above. If your credit utilisation is too high, you’ll ideally need to pay off some debt. Though the utilisation isn't important if you've a low debt ratio (as the fact you're using most of your credit isn't a biggie if it's only a small part of your income.) But it will come into play if you've got more significant debt.3. Disposable income

This is how much spare cash you have each month after bills and essentials.

This time, higher is better. Essentials include housing costs, debt repayments, and other bills you and your dependants must pay. For cards & loans, it's done via a statistical calculation for a typical person in your position, rather than looking at your actual incomings & outgoings, so there's not much you can do to change it.

-

Fraud scoring as well as credit scoring can cause rejection

When you apply for a product, it isn't just a case of assessing whether you're desirable, but also checking the application is legitimate. So, as well as the credit reference agencies, lenders also use separate anti-fraud agencies to try to weed out problems.

Here is how the two big agencies work:

National Hunter

This rarely mentioned system is much less factual, and so is prone to greater errors. However, it's used by almost all major banks and building societies, receiving 96,000 applications a day, and has a real impact.

CIFAS: Lists confirmed past fraud

It is simply a record of known fraud, so if you're on there, in general, you should know about it. It's also the organisation to speak to if you think you've been a victim of ID fraud. Worryingly, any fraud committed at your address in the past could appear on your CIFAS file, even if it was nothing to do with you.

It works by looking for inconsistencies between your current application form and any past applications you've made, trying to spot factual errors. While it can't block your application itself, it triggers a red warning flag to lenders, and this happens roughly 7% of the time. Lenders can then check the info, and ignore it or do further checks. They're not allowed to reject you based on the National Hunter red flag alone.

Factors such as a number of applications in a few days can also trigger warnings, though generally that's more acceptable with mortgages, where it's more common, than with credit cards.

What to watch for

It's crucial to be consistent, even over long periods, when you fill in application forms. If you have a number of job titles or phone numbers, try to use the same one on every application.

How to check your National Hunter file

To check the info it holds on you, you'll need to make a subject access request, which is free thanks to the introduction of the General Data Protection Regulation in May 2018. This can also be a useful thing to do if you think you're a victim of ID fraud.

What you'll get is essentially a list of the information you've put on past applications. If there's an error on the file, which is possible, you can't correct it directly with National Hunter. If this happens, you'll need to go back to the lender that submitted that application in the first place to have it corrected.

As with National Hunter, a lender can't refuse your application based on the CIFAS data, but must investigate first. Hopefully, that should prove you were not the perpetrator.

How to check your CIFAS file

The info it holds on you should be contained on your credit report under the CIFAS section. You can do a subject access request for information CIFAS holds on you for free. Find out how to do this on the CIFAS website.

If you've a dispute with the information it holds, you need to contact the company that logged the information on your CIFAS file first. If you're not happy with the response, you can ask CIFAS to investigate after you've received a final response letter.

Find out more about how National Hunter works...

Find out more about how CIFAS works...

-

Credit scoring affects far more than you think

Since the credit crunch started, the importance of credit scoring to our financial lives has grown rapidly. Here's a quick rundown of how credit scoring affects major financial areas.

Mortgages. If your credit score is poor, you'll be rejected. It really is that simple. If you're planning to get a new mortgage or remortgage, it's worth starting to manage your credit file at least a year in advance.

For specialist help, read the free First-time buyers' mortgage guide or Remortgage guide.

-

Credit cards. Your credit score dictates whether you'll be accepted, whether you'll be given promotional rates, and the APR you'll be charged afterwards. See the Best balance transfers, 0% spending and Credit card best buys guides for full info.

-

Loans. Again, your credit score matters both for acceptance and the rate you'll pay. See Cheap loans for help.

-

Utility bills. Sharing data is now spreading to utility companies too, making it even more important to pay your bill on time, or it could harm your chances of applying for other credit such as a loan, credit card or mortgage. Of course, paying it on time can help your chances too.

Mobile phones. If you're getting a contract mobile phone, you're credit-scored (usually because the company is spreading the cost of the handset over the contract, so for the firm, it's effectively a loan). If you're rejected, you won't get a contract, and will have to stick with pay as you go.

-

Car and home insurance. If you opt to pay monthly, then in practice the insurer is loaning you the money to pay upfront, spreading the cost over the year and charging you interest (often at 20%+ APR), so it does a credit check first. See Cheap car insurance and Cheap home insurance.

Before you read how to boost your credit score, you may also want to check out...

Check your credit file for free. We explain how.

First-time buyers' guide. Boost your chances of being accepted for a mortgage.

Remortgage guide. Boost your chances of being accepted for a remortgage.

Credit card eligibility calculator. Check your chances of getting a top credit card.

Credit cards for people with bad credit. See our top picks.

28 tips to boost your credit rating

Each lender scores you differently, so this is more art than science, especially because lenders are tight-lipped about what they're looking for.

Yet there are practical things you can do that should help reduce credit-scoring and fraud-scoring rejection.

-

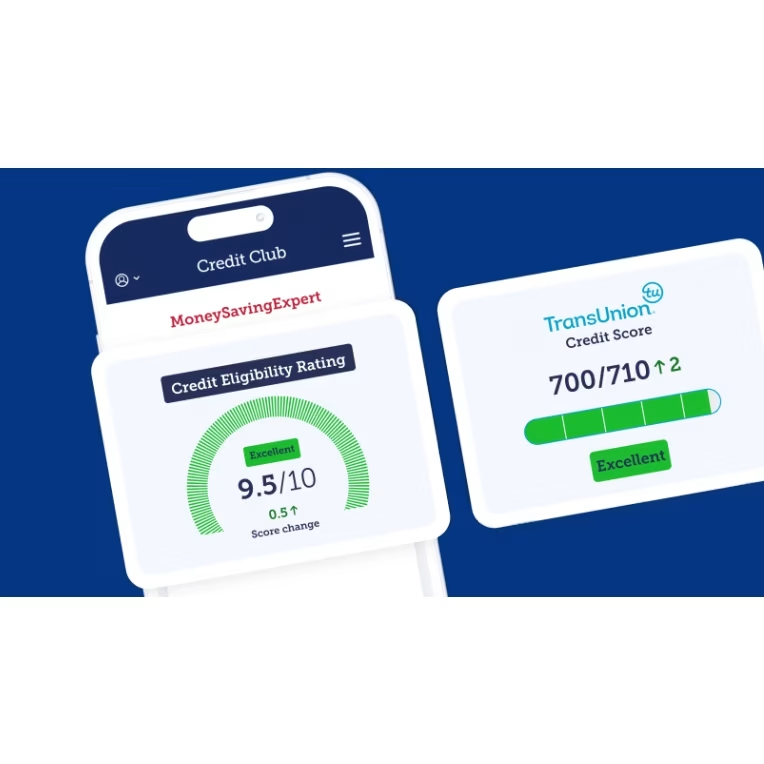

Sign up to MSE's Credit Club – which includes your free TransUnion credit report (and much more)

MSE's Credit Club shows your real-world credit power – which translates to acceptance for credit cards, loans & more – and explains how to improve things.

It uses a new Eligibility Rating which combines the THREE crucial factors that dictate whether a lender will accept you, to show a far bigger picture...

1) Your credit score

2) Your affordability score (which, crucially, includes income)

3) Current market conditionsOnce logged in, it'll show your TransUnion credit report and score. Plus, it’ll give you access to our eligibility calculators for credit cards, loans and mortgages, allowing you to see the deals you'll most likely be accepted for, without impacting your ability to get future credit.

-

Boosting your credit score is like going on the pull

You need to make yourself as attractive as possible to lenders, in the hope you'll fit their bespoke lending criteria. Just like in real life, where we're not all attracted to the same people, credit scoring's the same. Different lenders want different things, so one rejection may not mean a rejection by all.

Some borrowers are unattractive to almost all lenders (ie, most will turn down bad risks). However, a small few may be drawn those with poor credit histories, as they can charge more.

And unfortunately if you do get rejected for lending, you're unlikely to be given a detailed reason. The most you're likely to hear is that: "Your credit score wasn't high enough."

The tips below are to make sure that lenders see you in the best possible light.

-

Check your credit report annually or before any major application

Your credit reference reports, held at Equifax, Experian and TransUnion, contain enormous amounts of data on you. Errors happen and can kill applications, so check them regularly and to go through line by line to check nothing's wrong.

If possible, check your report at all three agencies, as different lenders use different agencies – and don't assume the info will be identical on each.

It's always free to check your credit report. See our full Check credit files for free guide, which also includes info on what to check.

-

Register to vote or it's much harder to get credit

If you're not on the electoral roll, it's much harder to get accepted for credit, so sign up immediately. Don't wait for the annual reminder or for the elections to roll around, apply at any time on Gov.uk.

Simply follow the instructions online – it'll ask you a series of questions aimed at identifying you, and the local electoral borough you need to register with. Note that you'll need your national insurance number to hand.

Many worry some councils sell on the data. But you can opt out of the open electoral register which can be used for marketing.

Credit reference agencies are allowed to use the full register which you can't opt out of and that you should, by law, be on. The electoral roll can be a factor in scoring, but even where it isn't, not being on it can lead to delays as lenders also use it to check your address and ID.

It's worth noting the credit scores sold to you by credit reference agencies may show you've a perfect score without being on the electoral roll. Don't let that fool you into thinking not being registered won't affect your ability to get credit. It will, because lenders also need to be sure you are who you say you are.

-

Not eligible to vote in the UK? Add a note to your file saying you have proofs of residency

If you aren't eligible to vote in the UK so can't be on the electoral roll (mainly non-Commonwealth and non-EU foreign nationals), ask all three credit reference agencies to add a 'notice of correction' to your credit file saying you can provide proof of residency (utility bills, a UK driving licence, etc) to lenders. Lenders will see the note when reviewing your application and should then ask you to provide those proofs, helping you get credit.

Credit reference agency Equifax suggests you may want to say something like the following in your notice of correction:

"I, (full name), with date of birth (dd/mm/yyyy) am not on electoral register at my present address, because I’m not a British citizen. I’ve lived in my current address since (dd/mm/yyyy) and can provide utility bills or bank statements to prove this if needed. Please take this into account when searching my credit report."

Some foreign nationals (from Republic of Ireland, some Commonwealth countries and EU citizens) are allowed to vote in local elections, and therefore can be registered on the electoral roll in the normal way.

-

Never miss or be late on any credit repayments – it can have a disproportionate impact

Sounds obvious? Well, it is. Even if you're struggling, try not to default or miss payments because it can have a disproportionate impact. Doing this once or twice could cause problems that can cost you for years. Defaults in the previous 12 months will hurt you the most.

The easy solution is to pay everything by direct debit, then you'll never miss or be late. While we normally caution against only making minimum repayments on debts (see the Danger: minimum repayments guide) one technique is to set up a direct debit to just repay the minimum, purely as a vehicle to ensure you're never late. Then manually pay more each month on top.

If you are in difficulties, the cliché "contact your lender" is a good one. Hopefully it will try to help. Changing your repayment schedule is preferable to you defaulting – and though it will hit your credit score, it's better than a county court judgment or decree against you.

-

Don't let your partner or flatmate's score wreck yours!

It's not usually whether you kiss, hold hands, live together or even being married that links your finances, it's simply whether you have a joint financial product.

If you are financially linked to someone on any product, that means their files can be accessed and looked at as part of assessing whether to accept you. Even just a joint bills account with flatmates can mean you are co-scored.

Therefore if your partner/flatmate has a poor history, keep your finances rigidly separate, and it should maintain access to good credit for you. If your finances are already linked and you've split up with your partner or moved out of your flat-share, make sure you take the time to financially de-link and ask the credit reference agencies for a notice of disassociation (more on this in the next point).

There are currently only four products that can infer financial linking – a joint mortgage, a joint loan, a joint bank account (not savings as they don't go on credit files), and in certain circumstances, your utility bills. Being jointly named on a bill with a flatmate shouldn't mean you are financially linked – this should only happen when the energy firm is confident you're a couple.

Note that while many people think they have a "joint" credit card, these technically don't exist. It's one person's account, the other just has a second card to access it.

-

If you've split up, ensure you financially de-link too

If you split up with someone you've had joint finances with (or just moved out from your flat-share), once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. Or call up, or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they can't do this if you still have a joint account open with the ex. The account'll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Be aware that you'll need to contact each of the credit reference agencies separately to ensure the disassociation is logged with all three, rather than with just one or two.

-

Minimise credit applications by using our free eligibility calculators

The only way to know if you'll get accepted for a product is to apply. Yet that leaves a footprint on your credit file, and too many of those, especially in a short space of time, can hurt future applications. This is a catch-22, as if you get rejected, or the rate you're offered is rubbish, you'll want to keep applying.

So to fight back, we've built free eligibility calculators to help you.

These use a soft search (so you see it on your file, but lenders don't so there's no impact) to show your odds of acceptance for the top cards (and loans), so you can hone and minimise your applications.

We also have a Loans Eligibility Calculator, which'll help you find your chances of getting different loans...

You only need to fill in your details once using the eligibility calculator to find your chances for all cards from the card category you click on. The Loans Eligibility Calculator is separate, so if you're looking for both cards and loans, you'll need to use both calculators separately.

What are good odds?

Some will find they're pre-approved for cards or loans. This means that you'll get that card or loan, subject to the lender's ID and fraud checks.

Yet if you're not pre-approved, anything above 70% means you've a strong chance of getting the credit (though it may not be at the advertised rate). Anything above 50% is also pretty reasonable. Anything below, and you're taking a chance.

However, don't let that scare you off applying for important products like balance transfers. I often hear: "I didn't apply. I only got a 20% chance, and didn't want to risk a rejection". Yet if your best chance is 20% and it's a crucial product, like a top balance transfer to cut your debt costs, 20% means two in 10 in your situation WILL be accepted, and you may be one of those.

As Adam emailed me recently:

"Hi Martin, thank you. I've been listening to your podcast for two weeks now and have already saved £3,728. First the Help to Save scheme... then balance transfers. I applied to the top eligibility checker result, which I'd only 20% chance, and guess what? I was accepted and offered a £3,500 limit at 0% for two years. This debt was 20% APR. I can now focus on other debts, potentially having an extra £1,328ish over the 0% period to reduce the amount owed."

So if you're not sure, remember, one search on your file isn't that big a deal, and what's the point of managing and protecting your credit file if you can't use it for key products to cut your costs.

-

Check addresses on old accounts

This may sound bizarre, but a wrong address can have a disproportionate impact. If you had, for example, an old mobile phone contract or credit card that you don't use any more, but is technically still listed as active on your credit reference files, then check the address is your current one.

If the account is still listed as open, and it lists you as being at a different address, this can stymie applications due to ID checks. Check your file and go through every active account's address to ensure it's up to date.

We've known people being rejected for mortgages because of this. Worse still, they didn't know the exact reason why as that's a nightmare to find out.

-

Don't 'spend' your applications too often

Every time you apply for a credit product (be it a credit card, contract mobile phone, car insurance paid monthly or more), it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you're desperate for credit. Therefore, space out applications if you can and don't do them frivolously.

In fact it's almost worth thinking about applications as 'spending'. Is it really worth spending an application on what you're doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you're just about to apply for a mortgage, wait until after you've done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don't get the credit limit you need, don't automatically apply for another one. Read the Low credit limit guide for more information.

-

Always check your credit files after rejection

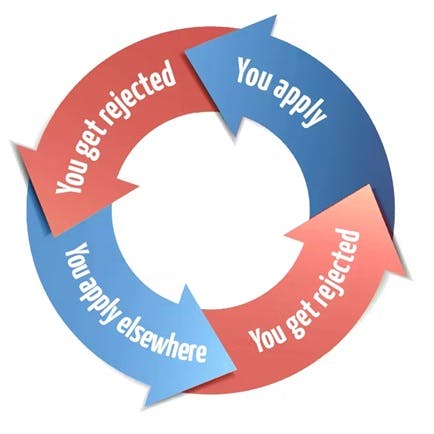

There's a nightmare scenario you need to avoid called the rejection spiral:

You apply again. You're rejected, not due to the error, but because of recent 'searches'. This continues, until finally you check your files and get the error corrected.

So, if you're rejected once, check your files are correct immediately. Otherwise you may mess up your score for an age, as more applications mean more searches, compounding the problem. You'll be told by the lender which credit reference agency it used to assess your info, so focus on that one.

After an error, it's possible to get successive searches wiped, but it involves negotiating both with the agency and the lender, and it isn't easy.

The rejection spiral also applies when you apply for credit normally reserved for those with an excellent score when you, say, only have a good score (sadly, many lenders don't publish their criteria so it's difficult to know in advance).

If you're thinking of applying for a new card, check our best buy credit card guides. Our eligibility calculator gives an indication of which loans and cards are likely to accept you, plus those likely to turn you down.

-

Use a credit (re)build card to build a history & restore past issues

Credit scoring is all about trying to predict your future behaviour based on your past history. Those with a poor history do poorly; but so do those with little credit history, as then predicting is tough.

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full Credit cards for bad credit guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won't be charged interest. Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren't using, then you can do the same on that without the need to apply for a new one.

-

Time it right – when you apply can have a big impact

Problems such as county court judgements and bankruptcy stay on your file for six years, and data about applications for one year. So if you're near a time when old issues will lapse, holding off applying can help. Check your credit file for details.

-

Don't withdraw cash on credit cards

This is both expensive to do, as interest is higher and you're charged it even if you repay in full each month. Crucially, lenders often see it as poor money management.

While withdrawing cash on one occasion may only have a small impact on your credit score and file (lasting up to circa three months), repeated withdrawals are likely to have a larger - and longer term - impact.

The one exception is withdrawing cash on a specialist card abroad. See Overseas credit card ATM withdrawals for full info and why they're not too bad.

-

Paying your rent on time can boost your credit rating

Sadly, paying £1,000 a month in rent doesn't help much to prove you can afford to spend £1,000 a month on a mortgage.

Yet there are free schemes that private renters and social housing tenants can use to boost their credit ratings.

Typically you'll need to be signed up to these schemes for at least six weeks for your rent payments to actually start appearing on your credit file. Some have reported seeing significant improvements in their credit reference agency scores, including one person who reported a 250-point jump over four months.

It's worth noting that the only way you'll potentially reap the benefits of this is if you always pay your rent on time. Miss a payment and it'll show up in your file and could be off-putting to lenders if/when you apply for a credit product.

There are three free options to choose from – one which your landlord has to sign up to and two that you can sign up to yourself.

Scheme that your landlord can sign up to:

Rental Exchange Initiative. The Rental Exchange Initiative* records your rental payments by adding them to your Experian credit file. Lenders that use Experian can then see that you've been paying your rent on time. Your landlord needs to sign up, but it's free for them and you, and their incentive is it help encourage on-time rental payments. Here's how to get them to sign up:

- If you're in social housing. Ask your social housing provider if it's part of the scheme. If it is, your rental payment information should be automatically recorded (if you don't want to be part of the scheme, you'll need to opt out). If it's not, you could send them this info for social housing providers to help encourage them to join.

- If you're a private tenant. Ask your landlord or letting agent if they're part of the scheme, though it's not likely unless your landlord's company has 500+ properties. If they are on it, request your landlord or letting agent to add your payment information to the system. If not, you could try and encourage them by sending them this info on the Rental Exchange*.

Schemes that you can sign up to:

Credit Ladder. You can use Credit Ladder* (go via our link for a £15 Amazon voucher when choosing the paid for options) and it'll report your rent payments for free to either Experian, Equifax or TransUnion (you choose which one). You can get them added to the files of all three credit reference agencies if you want, this costs £8/month (or £60 annually, equivalent to £5/month, if you're willing to pay for a year's subscription).

Canopy. Alternatively, connect via Canopy to the bank account from which you pay rent, Canopy will use Open Banking to verify and monitor rent payments and add them to your Experian credit file for FREE. You can get them added to the files of all three credit reference agencies if you want, but this costs £7.99/month (or £84 annually, if you're willing to pay for a year's subscription).

As lenders sometimes check two credit reference agencies when deciding which borrowers to accept, if you use Canopy for Experian, you could then use Credit Ladder for one of the other two agencies, getting you two out of three agencies free.

-

Payday loans can kill mortgage applications

Some payday lenders disingenuously suggest that taking them out and repaying on time can boost your credit score, as it starts to build a history of better repayment. This is true to a very minor extent for those with abysmal credit histories – though using a credit rebuild card correctly is generally both more effective and far cheaper.

If you're getting a mortgage though, by definition you'll need a far better than abysmal credit score. So you should avoid payday loans like the plague. Not just because they're hideously expensive – see the Payday loans guide – but because some mortgage underwriters (the ones who decide if you'll get a mortgage) have openly said they simply reject anyone who has had a recent payday loan, as it's an example of poor money management.

Historically many people have been mis-sold payday loans they couldn't afford to repay. If that happened to you, you can reclaim £100s or even £1,000s – and request that any poor payment records on loans deemed to be 'unaffordable' are removed from your credit file. See our Reclaim payday loans for free guide.

-

Be careful with buy now, pay later (BNPL)

Millions of people use buy now, pay later when shopping online or in store. But using BNPL too much, making late repayments or missing them altogether, could negatively impact how lenders see you via your credit report. As BNPL becomes increasingly visible to lenders ahead of sector regulation from July 2026, this is something to think carefully about.

On the other hand, using BNPL responsibly and making sure you always repay on time could paint a more positive picture on your credit report – especially if you have a limited credit history.

But be warned, BNPL is currently unregulated and easy to access, which means you have less protection and it can be easier to get into debt. So, if you are planning to use BNPL to bolster your credit file, be sensible – it may be that there are better ways for you to do so. See our alternative options to boosting your credit file.

-

You can ask why you were rejected, but never pay for credit repair

If you apply for credit and are rejected, lenders are supposed to give you an explanation if you ask for one. It's worth doing, but usually you just get "because you failed to meet our credit scoring requirements"...

If you see these advertised, avoid them. Either they're doing nothing you can't do yourself with ease, or they're using illegal methods that will bite you on the bum. If you're struggling and need personalised, professional help, see a non-profit debt-counselling agency.

-

Stability counts, use consistent details between applications, don't overchurn

Homeowners rather than renters, and those who are employed, rather than self-employed, tend to be more readily accepted for credit. Having the same employer, bank and address for a while all help too.

Keep personal details the same between applications. It's crucial to be consistent, even over long periods, when you fill in applications. If you have a number of job titles or phone numbers, try to use the same one on every form. If you use different ones, you might be flagged up by fraud scoring.

Lenders can't reject you just for this, but they should tell you if National Hunter has been a contributing reason why they declined you for credit.

-

Life change coming? Apply before that happens

You also score higher on lenders' wish lists when you're earning, so if you may be going on maternity leave, taking time off, or if you suspect potential redundancy, apply beforehand – though never lie about your details.

-

Should you cancel unused credit and store cards? Sometimes...

Whether cancelling old cards will help or hinder your ability to get credit in the future isn't an exact science.

In general, if you have a lot of old cards that you're not using, you should look to cancel some of them, especially if you don't check them often, as they could be used fraudulently. However, there are cards you should try to keep...

The card that has your highest credit limit. This card is likely to be seen as positive on your credit report, as it shows that other lenders trust you with a large amount of credit. It's best not to close this card unless you've other cards with similar limits.

The card you've had the longest. Lenders like to see stable financial relationships. So, if you'd had one card for ten years, and all your others are less than a couple of years old, shutting the old card will likely have a slight negative effect on your creditworthiness. If all your cards are of a similar age, this likely won't matter.

The only credit card you have. If you only have one card, it's best not to shut it, as then lenders wouldn't have any evidence about whether you manage card debt well.

If you're not using the card, it's likely worth adding, say, £50 of normal spending each month and paying it off IN FULL. This will help keep your credit history current.

The other reason you might keep a credit card is down to your 'credit utilisation' – this is a fancy way of saying 'how much of the credit available to you are you using?'. It's best to aim for a figure around 25% or less (and it's best if it's not all concentrated on one card).

So, for example, if you're maxed out on two cards with £2,000 limits, and you've also a card with a £6,000 limit that you're not using, then your credit utilisation is 40% (you've £4,000 of debt and a combined credit limit of £10,000).

If you closed the £6,000 limit card, your credit utilisation would shoot up to 100% – which would be a real red flag for lenders. They'd likely see it as a sign you're desperate for credit. So here it'd be best to keep the £6,000 card open (and, of course, aim to pay down the debt on the other two cards).For more on credit utilisation, watch Martin's video below.

Quick question

There is a big confusion here, and the only way to dispel it is to shout loud...

Cutting up a card is NOT the same as cancelling!

Snipping your plastic in half simply stops you using it, but the credit card will still be open, and will show as active on your credit report.

To properly close the account, call up the card company and tell it you want to cancel the card. If possible, ask for confirmation in writing, as sometimes firms don't action it.

Even once you've cancelled, it doesn't mean the account is closed. It'll often be left open for a short while in case any payments still need to come through, so always double-check your final statement to ensure everything's gone through. Then check your credit report a few months later to double-check it's done and dusted.

In other words, just to make things difficult: cutting up doesn't mean cancelling, and cancelling doesn't always mean closure.

Funnily enough the mere attempt to cancel may reap rewards. Often when you do this, the credit card company will try to tempt you to stay with some form of special offer deal. Such offers are always worth considering, especially for those still needing to borrow.

How do I cancel a card properly?

Martin Lewis explains how lenders actually analyse whether they will accept you

Martin Lewis explains how lenders actually analyse whether they will accept youThis clip has been taken from The Martin Lewis Money Show Live on Tuesday 30 January 2024. With the kind permission of ITV Studios. All rights reserved.

-

Experian Boost can give a limited, er, boost.

Experian Boost* is a free add-on that uses open banking data to show lenders you're making on time repayments for things such as council tax, Netflix, Spotify and even regular savings transactions.

In other words, it compiles a separate history of regular payments over the past 12 months that are not normally recorded on your credit file.

While there's no guarantee using Boost will actually boost your score, Experian says it won't ever harm your credit score, so it's worth a try.

Mortgages

Currently Leeds Building Society is the only major UK mortgage lender to use Experian Boost when considering a mortgage application.

Be mindful Experian Boost will likely help first-time buyers more than it will those who've already got a mortgage, as repaying an existing mortgage tends to be more impactful on a credit file than paying direct debits (though that's not to say remortgagers wouldn't benefit to some extent too).

Specialist lender Generation Home (Gen H) has also started using Experian Boost when considering mortgage applications.

Credit cards and loans

Virgin Money and Zopa are among the lenders to use Experian Boost when considering credit card and loan applications.

-

Reduce your debts with savings, if you have them

The amount of outstanding debt you have is part of the information lenders have access to. If you've too much debt, then that hurts your file. After all, would you want to lend to someone who already had a lot of debts to pay elsewhere? So minimising this is a clever strategy.

In general, you'll be better off using savings to pay off expensive debts anyway (read Pay off debts with savings to find out why).

This is particularly true if you're applying for a mortgage – the less you're borrowing in proportion to your house's value, the better deal you can get.

-

Default on your credit report? Mitigate the damage

One of the major problems people face are defaults on their credit reports – in other words, when it shows you didn't pay but should have done. These, especially if they're recent, are a hammer-blow when applying for new credit.

Note that it’s not uncommon for a default to be sold to another company if there’s still an outstanding debt to be paid. When this happens, the original default will show as ‘satisfied’, and a new default account will be created. Any payments to clear the debt will now be made to the new lender.

The good news is your credit score isn’t impacted twice if this happens. There will be a marker on the original account that lets future lenders know it’s been sold. It lets them know if it’s been sold to a company who shares the account with the same credit reference agency, or with another agency. This ensures the default isn’t double-counted when you apply for credit. Importantly, the original default date stays the same. This means it will still be removed from the credit report after six years.

If the default shouldn't be there, read how to challenge unfair defaults below. If it's genuine and fair, your options are limited. After all, credit reports are there to show lenders your history.

There are two steps to trying to sort if a default shouldn't be there:

-

Step 1: Negotiate with the lender. If you're prepared to settle the debt, in part or in full, then you can negotiate with whoever you owe the money to. You can also ask to make it a condition of settlement that the default is wiped off your credit report. If you're not sure, speak to a non-profit debt-help agency.

-

Step 2: Let time heal it. If negotiating with the lender didn't work, the other route is to allow time to heal it – defaults stay on your credit report for six years, but even before that, the longer ago the default was, the less impact it has, especially if your more recent credit behaviour has been impeccable.

-

-

Unfair default or other error on your credit report? Fight it

If you discover an unfair default on your credit report, you need to dispute it as it will block most applications. Check if the same default is on the other two credit reference agencies' reports.

Unfair defaults can occur for a number of reasons. It could be a simple clerical error by the credit reference agency, in which case contact it to get it removed – they are usually helpful.

More likely, though, is the lender has put it there in error, or that you were in dispute with the company over whether you owed it the money or not.

Try the following three-step process:

-

Step 1: Complain to the lender that added the false info to your report. Write to or call the company which put the default on your report to ask for it to be removed, telling it your reasons why the default is unfair. Keep this formal, polite and to the point. Tell it you'll be taking it to the Financial Ombudsman if the default isn't removed.

-

Step 2: Add a notice of correction to your report. If that fails and the default's still there, add a notice of correction to the credit report explaining the problem, eg, "it was a joint account and the debt was run up once I had split from my ex-husband/wife," or "the debt was for a pair of shoes from a catalogue but they never arrived so I refused to pay it".

Don't go on too much when explaining the error. Be concise and factual.

This will slow applications down, as a notice of correction means most companies will look at your application for credit manually, rather than it simply going through a computer algorithm. But as a substantial default is likely to stop you getting credit, that's usually not a problem. -

Step 3: Escalate your complaint to the relevant ombudsman. Most complaints about credit reports – as they're most likely to be about banks, insurance companies or other lenders – should be addressed to the Financial Ombudsman. It can adjudicate that the default is unfair and ask for all traces of it to be removed (and order recompense for damage if appropriate).

If your complaint is with an energy company – perhaps it's saying you owe it money when you don't, leaving a mark on your report – then you can also take it to the Energy Ombudsman. Similarly, the Communications Ombudsman will help if it's a broadband or mobile company. Both can order companies to remove information from your credit report.

For help in making your complaint, see our Complaining to the Financial Ombudsman guide.

-

-

Paying insurance monthly affects your credit score

If you decide to pay for insurance in monthly instalments, a 'hard search' will be carried out and this will affect your credit score. It's always worth paying upfront if you can – some insurance providers charge APRs of up to 40% if you pay monthly.

However, many people also worry that using comparison sites will also affect their credit score. Comparison sites share your information with a number of insurers. They look at your credit report to check who you are, provide you with quotes and to see if you would be able to meet monthly payments.

Yet the good news is that these searches are 'soft' searches, so other lenders DON'T see them and they won't affect your credit rating. Only you can see the search has been done.

For more information on this, including how to avoid it, see our Car insurance guide.

-

Ask for a 'quotation search' or 'soft search' if available

If you're just trying to get a specific quote for a loan, ask the lender to do a 'quotation search' or a 'soft search', not a 'credit search'. This means that while an enquiry will appear on your credit report, only you can see it. Lenders can't, so it won't have an impact on your credit score.

Sadly, many lenders haven't yet adopted this practice, but it's worth asking. If not, consider whether you really want to get a quote – if it's unlikely you'll get the product, don't bother.