MoneySavingExpert's Money Tips Email

|

|---|

|

DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

|

1. Do you have more expensive card, loan or overdraft debt? If so, they're generally worth prioritising using spare cash to clear ahead of your mortgage. See Should I overpay cards & loans? 2. If your mortgage rate's higher than the interest you can earn in savings, overpaying adds up. Here's a simplified example: £10,000 saved at top 4.5% savings earns £450 interest (£360 for those who pay basic-rate tax on it), yet use it to overpay a 6% mortgage and it saves you £600 interest. So using savings to overpay makes sense. It's a bit like saving, tax-free, at the mortgage rate. Then again, if you're still on a legacy cheap mortgage at 1% or 2%, there's no point in overpaying that for now (see point 7). Use our Mortgage Overpayment Calculator, which shows both your absolute gain from overpaying and the relative gain compared to putting money in savings.

3. Yet compare YOUR best possible mortgage against YOUR best possible savings. If your mortgage could be better and you're free to move, then check what the best rate you're likely to get is. Use our Mortgage Best Buys comparison for a benchmark, and free Remortgage guide for step-by-step help. The same's true with savings. If your accounts pay a paltry rate, as too many do, it's easy to ditch and switch (unless they're locked away in a fix). On lump sums, you can earn up to 4.5% in top savings and 7% on regular savings up to £300/mth, so that's what you should be comparing with. 4. TWO KEY CHECKS before you act. If overpaying looks a winner, check...

5. Got under 40% equity in your home? Even where the maths doesn't quite add up, overpaying may pay. If you can save at a higher rate than your mortgage, use our Mortgage Overpay vs Savings Calc to see the pound-for-pound difference. If savings are substantially better, save. Yet if they're only marginally better and your mortgage borrowing is over 60% LTV (loan-to-value) - the proportion of your home's current value you're borrowing - reducing your mortgage debt may lower the rate of future remortgaging offers (ie, when you get a new deal). With 1.8m fixed-rate deals ending this year, it's a consideration for many. See the LTV thresholds that may improve mortgage rates. 6. When overpaying, ensure the overpayments reduce your TOTAL MORTGAGE BALANCE (ie, reducing the term). Overpay and some lenders just reduce your next or future monthly repayments. That may help your future cash flow, but you won't see a big reduction in what you pay overall. That comes from ensuring overpayments reduce your mortgage balance while keeping the same monthly repayment. This has the practical effect of helping you clear your mortgage sooner, resulting in an interest (and time-saving) gain. So, when you overpay, tell the lender you want it to reduce the capital owed and/or the mortgage term and keep your monthly repayment the same. To be clear, that's NOT saying ask to reduce your term - that'll often need an affordability test. The priority is that what you repay reduces your mortgage balance and you keep up the same contractual repayments, so you'll be mortgage-free quicker (see my now very old Decrease term or overpay? blog for the general concept). If your lender makes this difficult by recalculating your monthly repayments, then just ensure you keep paying what you were or more (so effectively overpaying each time) and it'll have the same impact. 7. Still on a very cheap mortgage rate? Save the right way. If you're one of the few where your mortgage rate is still really cheap, say 1% or 2%, then you'll likely be better off in top savings. Yet it's worth being aware that at some point that deal will end and your new mortgage costs will likely be much higher. So you may want to consider having savings available at that point to reduce what you'll need to borrow. To do that, you'll want money in easy-access savings. This doesn't mean you can't use fixed savings before then, just make sure they mature just before your mortgage fix ends. 8. What about overpaying the mortgage vs investing? That's a much trickier call. If we're talking about money you don't and won't need for at least five years (which is when investing comes into its own and should be the prime option), then if your mortgage rate is low and likely to stay that way, investing looks more attractive. If your mortgage rate is higher, it's less so. The balance is a personal call based on risk attitudes (a bit of both is probably the right answer), I discussed this 'ponderable' in my Question Time podcast last week. |

|||||||||||||||

|

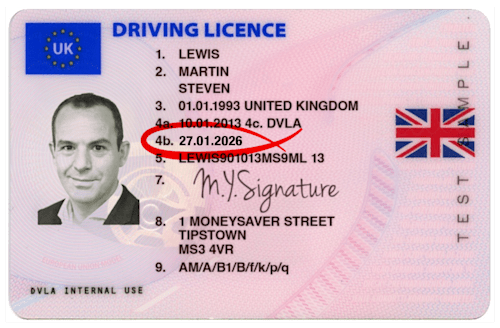

New. FREE TSB £255 for switching bank - biggest mainstream switcher this year. New customers switching their current account to TSB's Spend & Save* via this specific link get £150 upfront cash, plus £50 in April, and £5/mth cashback for 6mths (for making 20+/mth debit card payments) - and now a £25 Amazon voucher too (you'll get an email to claim it within 90 days). To get the £150, you must pay in £1,000+ once, log into its mobile app, and do 5 debit card spends. Pay in £1,000+ in April for a further £50. Full help & eligibility in our TSB review or see best bank accounts for more options. Ends Thu. Free 90-day Tastecard - no payment info or subscription needed. Gets 2for1 or 25% off the total bill at independent restaurants, as well as chains like Pizza Express, Zizzi, Burger King & more. Tastecard Martin: 'Beware! On a Plan 2 student loan? The Govt is freezing the repayment threshold - should you overpay now?' (Spoiler: yes for some, no for many.) In Martin's new long-read Plan 2 student loans help blog for mainly Eng & Welsh graduates who started uni from 2012/13 to 2022/23, things he covers include: What's changed to make Plan 2 worse? | A repayment threshold freeze warning | Millions have overpaid & can reclaim £100s | If you can overpay, should you? (inc an AI calc) | How Plan 2 compares to current Plan 5 loans and more. FREEBIES: £3.50 protein bowl, £2.50 dog treats, £2.40 kids' yogurt & more. See this month's freebies and discounts in 40+ supermarket coupons. Ends Thu. Shift debt to top 'all accepted get it' 36mths 0% card + poss £25 cashback & free Apple TV. A 0% balance transfer is where you get a new card that pays off debts on existing cards for you, so you owe it instead but interest-free for a set time. That way more of your repayments clear the actual debt. Barclaycard's 36mth 0% (3.45% fee) card is the longest definite 0% card on the market, plus accepted newbies who apply by 10am Thu and transfer £2,500+ within 60 days will also get £25 cashback & 12mths Apple TV. Golden rules: Repay at least the monthly minimum & clear the card before the 0% ends, or it jumps to 24.9% rep APR interest. Full info & more options in Top balance transfers. Martin: '5 must-do's to secure your data in case your mobile's nicked!' Watch Martin's 3min mobile security briefing via his YouTube (do subscribe). Or better, watch his full Slash the cost of your mobile show from last week on ITVX. Ends Thu. 50GB monthly data Sim less than '£4/mth'. This 50GB iD Mobile Sim (uses Three's network), with unlimited mins & texts, is £2/mth for the first 3mths, then £8/mth. Plus you'll be emailed a £32.50 Amazon, Sainsburys, Argos, etc, voucher within 4mths (check your junk folder). Factor that in and over 12mths, it's equivalent to £3.80/mth. Want different data? See Cheap Mobile Finder.

Choose a Grüum hair, skin or lip care item for just £1 including delivery (normally up to £14). MSE Blagged. 20,000 available. Grüum

|

|

You may know your Credit Score but have you checked your Credit FILE? That's what really counts. Contrary to what many believe, in the UK you don't actually have a universal Credit Score - no one number that dictates whether lenders will lend to you. Instead, each lender scores you based on its own wish list of what makes a profitable customer (the Credit Scores you get are just a credit agency's estimate of how a typical lender may view you). When a lender assesses you, it's aiming to predict your future behaviour based on your past. Most use three pieces of info for that: i) Your application form; ii) Any past dealings they've had with you; iii) Your Credit File/Report. And it's absolutely crucial you check your Credit File, as the email we just got from Andrew shows.

|

|

On district or communal heating? You now have stronger rights if something goes wrong. Regulations starting today (Tue) mean providers must treat all customers fairly, especially if you're vulnerable. See heat network latest. BT and EE to hike prices by up to £48/yr for out-of-contract customers. You're likely impacted if it's been 2+ years since you last switched. Full info & how to save £100s in BT/EE price hike. Ends Thu. Fast 300Mb broadband, Sky TV, Netflix & Discovery+ '£34/mth'. Sky newbies can get its 300Mb broadband, digital line & Sky Stream TV including Netflix (with ads), Discovery+ and Sky Atlantic for £35/mth (less than many are paying for slower broadband alone), plus you'll be emailed a £30 prepaid Mastercard within 4mths of signing up (do check your spam box). Factor that in and it's equivalent to £33.75/mth over the 2yr contract. The deal's accessible to 75% UK homes. Just want broadband? There's also this superfast 500Mb broadband & line-only Sky deal for '£24/mth'. New. Are you one of 850,000+ who OVERPAID for NHS prescriptions in 2024/25? If you pay for prescriptions (ie, you're in England), check NOW if you can save with a prescription 'season ticket'. £3 pint of Guinness at 800+ pubs this weekend via app. Excl N. Ire. See cheap Guinness (please be Drinkaware). Ground rents to be capped at £250/yr for leaseholders in Eng/Wal... But this and other leasehold reforms aren't expected to come in till 2028 at the earliest. More info in our leasehold update. Related: Should you extend your lease? No Big Energy Switch this week, we're afraid. We hoped to bring back our Big Energy Switch this week, but rising wholesale costs mean prices aren't good, so we're postponing until we get a deal worthy of the name. To get involved, you'll just need to either be receiving this email or be signed up to Cheap Energy Club. Don't want to wait? Check the top deals right now by doing a full market comparison. |

|

AT A GLANCE BEST BUYS

|

|

|

|---|

|

MONEY MORAL DILEMMA Should I ask my unwell friend to contribute to our restaurant cancellation fee? My friends and I had a restaurant reservation, but on the day one of them, who is a type 1 diabetic, was unwell. We had to cancel the table, which came with a £25 cancellation fee. I was happy to absorb this as it was out of her control, and didn't say anything to my friends. A couple of weeks later, I checked my credit card statement and there was a £100 charge from the restaurant - the cancellation fee was £25 per head, not per booking. Paying £100 myself seems very different from paying £25. Should I ask my friends, including the one who was unwell, for the money or do I let it slide? Enter the Money Moral Maze: Should my unwell friend pay towards our restaurant cancellation fee? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

|

|

|

|

|

|---|

|

MARTIN'S APPEARANCES (WED 28 JAN ONWARDS) Thu 29 Jan - Ask Martin Lewis, BBC Radio 5 Live, midday |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email admiral.com, lv.com, diamond.co.uk, elephant.co.uk, axa.co.uk, autoaid.co.uk, eversure.com, chase.co.uk, tsb.co.uk, clearscore.com Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |