Archive: MoneySavingExpert's Money Tips Email

|

|---|

|

DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

|

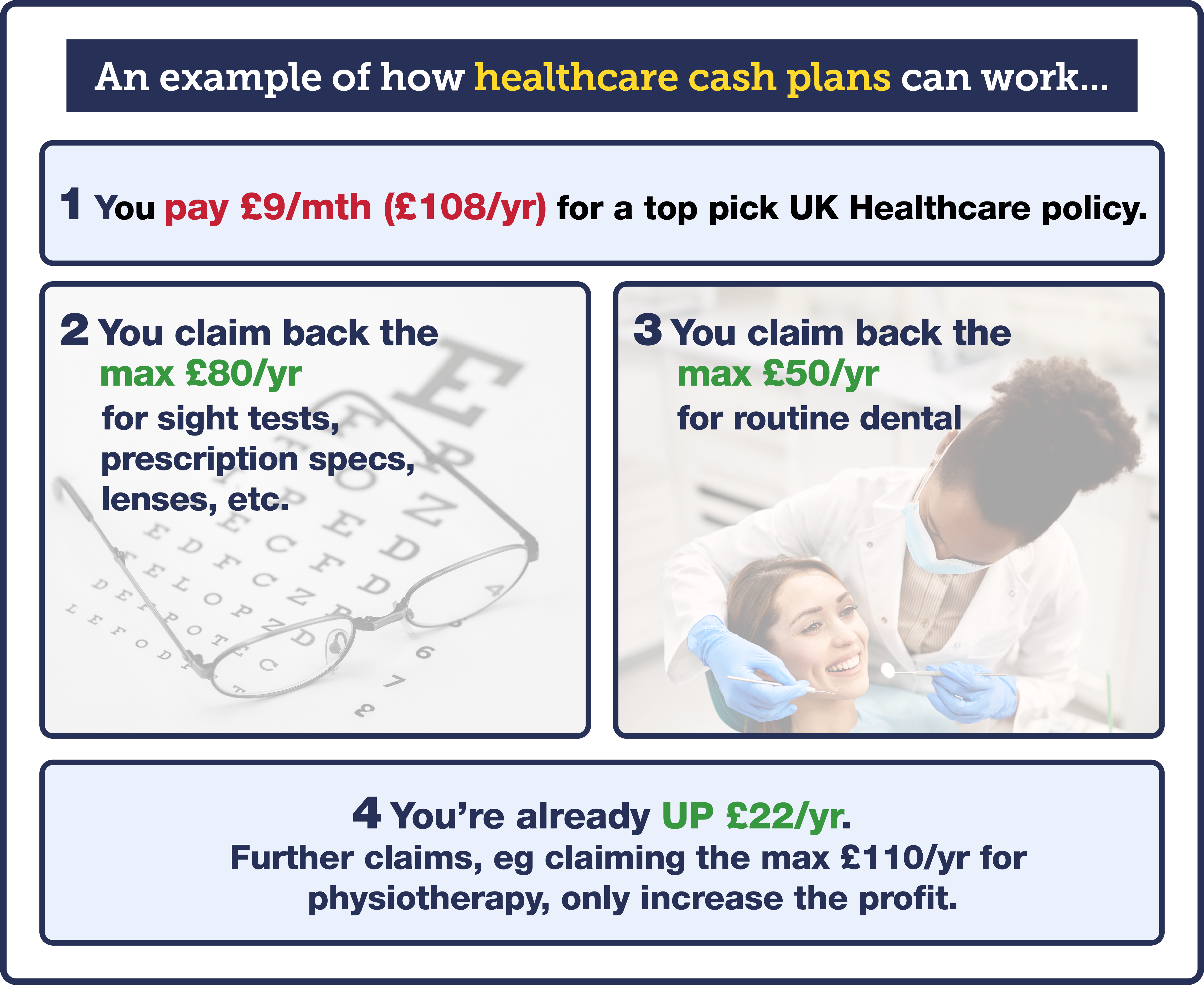

Get cash to help pay for NHS and private medical costs Do you shell out for dental, optical, physio, podiatrists, chiropractors, osteopaths, etc? If so, healthcare cash plans are the hugely underpublicised, cheaper cousin of Private Health Insurance - but far from the poor relation. You pay a small amount each month, and then when you pay for NHS or private treatments, you claim back some or all of the cost (up to annual limits - the more you pay, the bigger the limit). Our Top healthcare cash plans guide has full info, but here are five need-to-knows...

The type of things you can claim on healthcare cash plans include: - Therapies: Physio, chiropody, osteopathy, acupuncture So, tot up how much you currently spend on routine appointments, and calculate what you'd get back as a rough valuation of whether it'll be worth it. 2. The top healthcare cash plans. There are no comparison sites that we know of, so to try and help, we've calculated which plans give the highest potential payout compared to cost. We think that gives a decent (albeit imperfect) model of the best policies, yet it'll always depend on what you actually claim. See the top four healthcare cash plan policies for... If you're an employee, it's also worth checking with your employer if it offers a work-based policy. These can be extremely good value as bulk-buying power means firms can negotiate big discounts. Though as always, check the terms in detail before signing up. 3. DON'T bother if you're the type of person who WON'T remember to claim. Apathetic or disorganised customers - who pay but never fill in the claim form and send receipts after treatments - are what keep plan providers' coffers healthy. Yet if you are an organised type of person who always claims, you can turn the odds in your favour. 4. Most don't require a medical, and pre-existing conditions may be covered. Some usually exclude claims based on pre-existing conditions, but others, including top picks Sovereign Healthcare and UK Healthcare, won't exclude ongoing dental and optical issues (though may exclude other pre-existing conditions for a period of time). Even if pre-existing conditions are excluded, most usually play fair, so if you've had a shoulder injury, this wouldn't usually stop you from claiming physio treatment if you get a bad knee. 5. Most firms have a 'qualifying period', so you can't usually claim for treatment in the first few months (10 months for childbirth claims). This means you can't claim anything in that time. It's done to stop people joining for specific known conditions and then cancelling. PS: All the Healthcare cash plans we mention are regulated by the Financial Conduct Authority (double-check first if you're going elsewhere), so you can complain to the Financial Ombudsman if you feel a claim's been treated unfairly, though we don't often hear of that happening. |

|

News. Will your current energy fix be reduced by 'The Budget's £150/yr off bills' from 1 April 2026? Martin's pushed the govt to push all firms to pass the cut on to ALL customers, and to do it in a transparent way. This week, many have announced their plans, see our firm-by-firm who'll pass on the cut?, including a full explanation on how it'll work. Related: If you're not fixed, find your cheapest fix. The Christmas supermarket veg war is on: 1kg carrots, 500g sprouts & more from just 8p. Par-snap up the cheapest Xmas veg. Martin video: 'The audience's faces when I reveal investment returns...' The clip's been huge on social media when Martin, in his 'beginner's guide to investing' show, revealed the investment returns - watch the clip on YouTube, where you'll also find his 'Should I use an investment platform or a shares ISA?' video, or watch his full ITV investment special. Ends midday Thu. Easy trick to get free £10 Amazon voucher from Santander. Open any Santander savings account* via this link, put £100+ in it till 31 Jan, and you'll be emailed a link to your £10 Amazon voucher after 24 March. Its easy-access saver is the simplest option - it only pays 2%, but on £100 the voucher more than makes up for it. Then just withdraw your cash on 1 Feb and move it to top savings (though keep the account open till you get the voucher). PS: As it's savings, there's no credit score impact. Martin video: Aged 18 to 40? Get £1 in a LISA (even if you already own a home). With Lifetime ISAs potentially due to be replaced, in his quick YouTube vid Martin suggests getting £1 in now if you can. Full info in his new ISA help pod. Ends 11.59pm Wed. Shift debt to 35mths 0% AND get £20 cashback (covers the fee for many). A 0% balance transfer's where you get a new card that pays off debts on existing cards for you, so you owe it instead, but interest-free. HSBC's 35mth 0% card (existing HSBC customers use this link) is already the longest 0% deal, but right now shift £250+ to it within 60 days and you get £20 cashback. That all but covers the one-off 3.19% balance transfer fee (min £5) if you shift under £800, and is still far cheaper than its other long debt-shift competitors if you shift more. Golden Rules: Don't spend on it or withdraw cash, & clear it before the 0% ends to avoid the 24.9% rep APR interest. Full info & options in top balance transfers. Ben & Jerry's tub & two pizzas £5 (£14 separately). Costs less than ice cream alone. Cheap night in. Ends Friday. Free £50 in shares if you invest £100+. 15,000 left. MSE Blagged. Newbies to Trading 212 (ie, never had any of its products before), who open its Shares ISA or investment account using code MSE50 by this Fri (19 Dec) and then invest £100+ within 10 days (can be put in a huge range of funds or shares), get £50-worth of shares in a randomly selected well-known firm, eg, Apple, Google, Nvidia, Coca-Cola. The shares are added within 3 working days, you can then either keep them or sell them (but can't withdraw the proceeds for 30 days). See full info on T212's £50 shares for £100 invested offer. Ends 4pm Thu. FREE Hogwarts Legacy PC game - can cost £20+. The open-world Harry Potter game is currently free to download and keep forever. Related: See other ways to get free PC games. New MSE AI search, only in our app. We've updated the MSE app with easier navigation, a 'search-in-page' tool & the option to bump up fonts. Plus, full integration of Credit & Energy Club. Download or update for free via iOS / Android.

|

|

And then there was (just about to be) only three... Bank switching season seems to be about to come to a close for now. Two more 'free cash to switch' deals are being pulled in the next couple of days, by which point there'll only be three left, compared to the seven that would pay new switchers a few weeks ago. We suspect more may go soon too, so, unless your current bank treats you so well you're wedded to it, it's worth checking now while five banks will still pay you to switch (especially as many need the money at this time of year). Switching's usually quick & easy. To get the free cash, you need to use the bank's seven-working-day switch service (so it takes roughly 10 days). This closes your old account and moves all your money, Direct Debits and standing orders for you. Payments to the old account are auto-forwarded. You'll need to pass a not-too-harsh credit check.

|

||||||||||||||

|

£114 K-beauty bundle £50 (Laneige, Biodance, Dr Jart+ etc). 10-item skincare set, including retinol, toner, serum & cleansing oil from popular online beauty retailer Lookfantastic. Many on Universal Credit bureaucratically blocked from switching bank account - Martin writes to Sec of State. Up to 8.3m claimants face a complicated and bureaucratic process that could prevent them from accessing good accounts and switching incentives. See Martin's letter requesting govt fix it. NHS Staff: £10 off Uber Eats & FREE £20 of Xmas Day Uber rides. See 30+ NHS / care worker discounts. Morrisons shopper? Urgently check if you're due a share of £30m unused points. See Morrisons warning. 'I haggled with BT and saved £400+ a year.' Our success of the week comes from Claire, who emailed: "I wanted to thank you for your tips on haggling with BT. It took nearly an hour but by sticking to your guidance (and being polite and friendly rather than getting stroppy) I managed to get them to reduce our bill by £30/mth [a £360/yr saving], plus a further saving of £18/mth for the Sports package for the first 3mths. Well worth spending some of my day off saving a bit of money before Christmas." If we've helped you save or reclaim (on this or owt else), send us your successes. Problem with your elec smart meter - how long did it take them to fix it (or are you still waiting)? New rules on faulty smart meters are expected in 2026, we've been campaigning on it and want to check the latest state of play. Please take a couple of mins to fill in our Smart meter survey. |

|

AT A GLANCE BEST BUYS

|

|

MONEY MORAL DILEMMA My employer keeps overpaying me and isn't taking the money back - what should I do? My employer's been overpaying me by a large amount every month. I've flagged it with payroll and my managers via email; they thanked me and said they'd take the money back in small amounts each month. But that hasn't happened, they've kept overpaying me. I've been putting the extra money in a high-interest account, and while I've no intention of keeping it, friends and family say it's OK to sit on it and keep earning interest. But it's mounting up and starting to worry me. Do I keep chasing work about it or just wait for them to sort it out? Enter the Money Moral Maze: What should I do about overpayments from my work? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

|

MARTIN'S APPEARANCES (WED 17 DEC ONWARDS) Thu 18 Dec - Ask Martin Lewis, BBC Radio 5 Live, midday |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email amazon.co.uk, santander.co.uk, firstdirect.com Financial Conduct Authority (FCA) Note MONY Group Financial Limited is authorised and regulated by the Financial Conduct Authority (FCA FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MONY Group Financial Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |